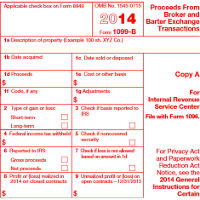

At JM Bullion, we pride ourselves on maintaining the privacy of our customers. This being said, although we do not report the majority of our customers’ sales to the government, we are legally obligated to file a 1099-B form when these sales apply to certain products or exceed a particular amount. Failure to report such sales could result in both civil and/or criminal tax penalties, as well as the possibility of imprisonment.

It is important for customers to understand that while the 1099-B form will require us to provide the some of the seller’s basic information, such as address and phone number, this information remains strictly between JM Bullion and the IRS. No other third parties will have access to this information. Customers, who would like to learn more about precious metals reporting policies, are strongly encouraged to either visit IRS.gov or consult with a professional tax expert.

The criteria for reporting precious metals sales will depend upon a number of factors including product, purity, and quantity. Each of which will be discussed in further detail.

When determining whether or not to report a sale, we first have to verify which particular products are being sold since certain pieces of bullion are exempt from reporting. Among the coins that are subject to reporting are 1 oz Gold Maple Leaf Coins, 1 oz Gold Kruggerand Coins, 1 oz Gold Mexican Onza Coins and any US coin composed of 90% silver. All bars and rounds are also subject to reporting regardless of size and precious metal composition. However, there are some restrictions with regard to the purity of each bar or round.

Another determining factor in whether a sale is subject to reporting is the purity or fineness of each particular bullion piece. Because the purity of coins is dictated by their inherent designs, there are no purity restrictions for the coins mentioned in the previous section. In the case of bars and rounds, however, the purity criteria will vary according to the item’s precious metal composition. Only sales on bars and rounds possessing the following compositions and purity levels will be subject to reporting: a gold fineness of at least .995; a silver fineness of at least .999; a platinum fineness of at least .9995; and a palladium fineness of at least .9995.

The final step is to determining whether a precious metal sale needs to be reported is to evaluate the quantity being sold. We are required by law to report all sales of 90% silver US coins exceeding a face value of $1,000 as well as sales of the previously mentioned gold coins, where more than 25 pieces have been sold. As with purity, the qualifying quantities for precious metal bars and rounds will vary according to their precious metal composition. Sales of gold bars and rounds need to be 1 kilo (32.15 troy ounces) or more before we need to report them. Likewise, sales of silver bars and rounds must reach 1,000 troy ounces. Lastly, sales of palladium bars and rounds need to be at least 100 troy ounces before they require reporting, while sales of platinum bars and rounds need to be at least 25 troy ounces.

Sales in which any of the previously mentioned items fail to meet the required purity or quantity criteria will not be subject to reporting. In addition to these such cases, there are a number of precious metal coins that are exempt from government reporting regardless of their sales quantities. These pieces include, but are not limited to gold coins of fractional denominations; American Gold and Silver Eagle Coins; US currency created after the establishment of the IRS’s Reportable Items List and any foreign currency pieces not explicitly mentioned in the above section.

These laws regarding reporting precious metals were established by the IRS during the 1980’s as a means of keeping track of any profits made by non-corporate sellers. They are primary for taxation purposes. They prevent individuals from using precious metals sales as an unreported source of income.

For more information on reporting bullion transactions, please see our Reportable Bullion Transactions Infographic and the video below.