A precious metals dealer is in business to sell metals. Dealers usually offer buy prices for metals, as well as sell prices. The spot price of gold or silver is in a constant state of flux. Gold , silver and other precious metals prices may move up or down based on many factors, such as…

When looking at different bullion dealers, one issue many people never really consider is the dealer’s Sell-To-Us policies and/or procedures. Bullion dealers are in the business of buying and selling bullion bars, coins and rounds. Many dealers are happy to buy bullion from customers. Remember, a precious metals dealer looks to profit from the spread…

In 1933, American President Franklin Roosevelt created the Emergency Banking Act, which stated that those who owned gold must turn it in to an approved bank. This did not include any personal jewelry, however. Executive order 6102 was a Presidential order signed by Franklin Roosevelt that forbade the hoarding of gold coins, gold bullion or gold…

The inclusion of precious metals within an IRA account can potentially offer the investor additional diversification and growth opportunities. There are, however, very strict rules and regulations regarding precious metals investments with an IRA account. In fact, there are only certain gold, silver, platinum and palladium products that are eligible for inclusion within an IRA…

When it comes to gold, silver, and other precious metals, or any type of investment for that matter, a person should have a firm understanding of the costs and/or fees involved in such an investment. If a person is looking to invest in a precious metals IRA, there are many associated costs that should be…

IRA accounts can be a great tool for savers. Traditional IRA accounts can allow one to save on a tax-deferred basis for retirement. Taxes on a traditional IRA are paid when distributions are made. For 2020-2021, the maximum allowed contribution to all traditional and Roth IRA accounts is $6,000 for those under the age of…

Customers have a number of options when it comes to funding their precious metals IRA. As with other accounts, funding can be as simple as putting aside a few dollars every week until you’ve generated the necessary funds to purchase your investment piece. However, we at JM Bullion realize that most customers are searching for…

For investors looking to add precious metals to their portfolios, the process is simple and convenient — even for those that already have existing IRA accounts. The process is called an IRA “rollover” and can be completed with ease and convenience. In a precious metals IRA rollover, one sets up an account with a self-directed IRA…

If an investor has made the decision to invest in precious metals with his or her IRA account, they must do so within a self-directed IRA account. What exactly is a self-directed IRA account, you might be wondering? A self-directed IRA is an IRA account in which the investor has control over what investments are made…

JM Bullion respects the privacy of our customers and never discloses any of their purchases to the government. We are, however, under legal obligation to report any cash payments we receive for purchases that exceed $10,000 dollars. This policy also applies to payments we receive within 24 hours of each other whose combined total exceeds $10,000….

An IRA is an individual retirement account. There are different types of IRA accounts available to people based on their goals and objectives. Some people may invest in an IRA account on a tax-deferred basis while others may invest in a Roth IRA on an after-tax basis. What type of IRA one should use depends…

With the prevalence of online precious metals dealers these days, people often wonder if they are required to pay sales tax on precious metals purchases, especially purchases made online. Here we will outline some information on this issue for informational purposes only. Nothing contained here should be construed as tax advice, and any questions relating…

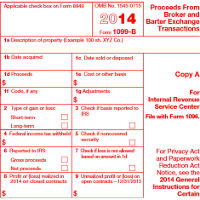

Form 1099-B is an IRS form titled “Proceeds From Broker and Barter Exchange Transactions.” This form is used to report gains or losses from transactions, such as stock purchases and sales, or the purchase or sale of precious metals for example. Among other things, the form requires detailed information on items, such as: Payer’s name and…

One of the more common questions when it comes to investing in precious metals is whether or not one has to pay taxes when selling their bullion at a profit. Here we will outline some of the general policies on precious metals taxation. Holdings in precious metals such as gold, silver or platinum are considered to…