Hey there, you made it!

Welcome.

Chances are high; you have already done this multiple times. For beginners especially, the standard start goes something like this…

You likely visited Google.com, Bing, YouTube (or perhaps another large internet search engine) and you entered in search terms like “silver investing” or “best gold dealer”. Maybe you searched something else similar like “best way to invest in silver” or “best silver coin to buy”.

If your search terms had the words “silver” or “gold” in them, that first page of your search result was most likely filled with retail silver and gold dealers who have consciously jockeyed for the specific search terms you entered.

Either through paid advertising or optimized website pages, the top to bottom results you were given were not necessarily the best results for your specific needs. As the search continued for you, you likely received contradictory advice.

Perhaps you reasonably questioned the credibility of the information you found?

Was the information relevant to your search?

Was the author credible?

Did the provided information fully answer your question(s)?

Was this an affiliate website designed for cash kickbacks on sales converted?

Are these reviews actually real or are they paid positive reviews written by paid bloggers or robot programs?

Do these people really have my best interests at heart?

Almost any human with a functioning synapse can start a blog or website hosting content about silver and gold investing. This does not mean the information they post will be accurate, interesting, helpful to your needs, or useful in any way to your search.

If you typically consume general silver and gold knowledge online, you most likely know there is a wide range of information spanning from great and truthful to flat out terrible and deceptive.

Granted, as the author of what you are now reading, I am but one of countless self-proclaimed experts within this space. I suppose it is your job too, to judge my credibility, to see whether or not I can indeed serve your interests by imparting my supposed knowledge here.

Just like when you look through silver and gold search engine results, I ask that you think critically about the information I am about to provide you.

You have your reasons for being here, for reading these words I am typing, and I’m quite certain I could guess a few of them.

I too have my reasons for creating this document for you. Allow me to explain them.

Today there are literally trillions of rationales for why investors should be buying and holding physical silver and gold bullion in their individual investment portfolios. It is my core belief that silver and gold bullion are the best 1-2-investment punch today and that is partly why I am happy to have created this report for you.

I’m not here to endorse nor inspire your particular buying motives.

I’m not here to give you long drawn out history lessons either.

I am simply writing this guide to help you make great buying decisions. To assist in aligning your intentions and investing interests with the right course(s) of action(s).

OK, now you might want to ask…

Who are you James Anderson?

Why are YOU qualified to give ME any guidance or perspective on this matter?

Yes! I am thrilled you asked.

This is my favorite part!

Here’s where I get to blowhard and brag about my past :)

I have made a living and invested first hand in the wholesale and retail silver and gold bullion industry since early 2007. In the business, I cut my teeth in the 2008 economic crisis working out of an honest bullion-to-door-delivering garage start up. We were completely understaffed, with phones ringing off the hook. Guess who was answering those phones with very little training?

Talk about learning the hard way! But learn I did.

Since 2008, I have professionally helped safely deliver millions of ounces of silver and gold bullion to people in over 100 countries. I have had the pleasure of consulting 1-on-1 with tens of thousands of investors living in the USA and abroad, helping them hone in their personal buying choices. I have even helped many investors decide on their very personal delivery decisions:

Even very private decisions, like where one hides their bullion within their homes, properties, farms, offices, gardens. You get the idea.

The level of trust these dear customers imparted me… I was humbled. I have been honored to serve them. Now I want to serve you.

I also have first hand research and buying experience in the growing silver and gold counterfeit markets. I personally worked with the Secret Service to help protect the public from counterfeit Silver Eagle coin dealers as well as rings of credit card fraud criminals. I cannot only show you how to avoid fake bullion, I also can show you how test any coins or bars you may already own today.

This past year I took part in the History Channel’s – America’s Book of Secrets program in an attempt to further get the word out on industry gold / silver scams and the ongoing threats of counterfeit silver and gold plated and tungsten filled bars.

Source: Twitter ➜ @JamesHenryAnd

For multiple years, I have been schooled first hand by an ex-IRS agent on IRS silver and gold dealer reporting requirements and thus I can show you what types of transactions are reported by dealers, and which ones are not. Knowing about dealer Anti-Money Laundering policies is super important if true privacy is of any interest to you.

The bottom line is this. I believe I have some unimpeachable wisdom, which can serve your goals and aspirations.

After graduating college with a BA in Finance in 2002, like most young people, I had no clue what I wanted to do with my life.

Looking back on it, I was sure of one thing… I didn’t want to go get an entry level job at age 22 and at the time, entrepreneurialism had been beaten out of me by schooling and the culture we were living in.

I decided it was time to travel abroad and learn Spanish first hand. This was an easy rationalization for living a few years in Central and South America and learning some things first hand outside of the American paradigm.

My personal experiences abroad from 2002 – 2005 helped set me on the path to write this report for you.

In my post university travels, I learned a lot about American interventionist past of the 1980s throughout Central and South America. I heard first-hand accounts and read about the training and allowance of tens of thousands of disappearing political adversaries in the Southern Cone region during the 1970s and 1980s. The narratives we don’t get taught much of in schools.

At the beginning of the 21st Century, the Internet was still in its formative years and some of what I learned were many of the ugly truths mainstream T.V. won’t touch. You know just some of the multi-varied reasons why “they” hate “us” for our “freedoms”. Supported kidnappings and torture, CIA led coup, and covert operations. But I digress.

I was also introduced to the wonderful world of overnight fiat currency devaluations, bank account freezes with forced currency swaps, bank withdrawal rationing, and its after affects on a society.

You see I traveled and lived amongst Argentines in 2003 and 2004. I witnessed the fallout from their nationwide overnight 2001, 2002 currency devaluation. The effects of this forced currency debasement on Argentine society were terrible.

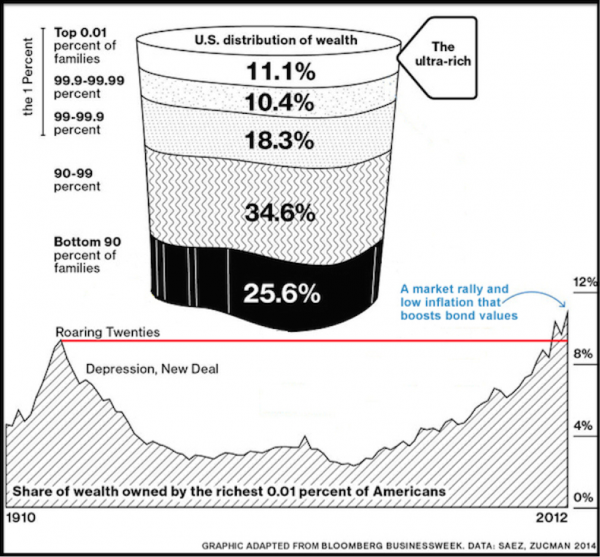

The Argentine financial insiders and the higher ups in the Argentine government with advanced knowledge of the country’s monetary policy changes (ones with direct access to bank credit and international finance) they got MUCH wealthier. But the middle class, well they got a lot poorer, and many got wiped out financially.

The disparity among the haves and have-nots widened as the middle class was crushed. The people’s confidence in almost every societal institution fell to the floor.

Does this sound familiar?

Source: David DeGraw

Like I said, I got to the Argentine bank freeze-festival a little late. And I being the Yankee traveler, I could enjoy my U.S. dollars buying me over three times as many goods and services as it once did only a few months back.

You see the Argentine peso went from 1:1 parity with the U.S. dollar (where it had been pegged for close to a decade) to an exchange rate of nearly 4:1 in a matter of months.

Sign in the bottom left reads: “Bank Boston thieves, give us back our U.S. dollars…” The bank accounts were frozen, all dollar accounts were converted to pesos and devalued.

Imagine having $10,000 in your bank account today, only to have $2,500 in your bank account after a central bank policy decision. Oh and by the way, in this particular Argentine example, your bank is now rationing withdrawals so you can only take out $250 per week. Good luck.

Conversely imagine you were a devaluation insider. What would you do? How about bank wire transferring your funds into an offshore bank account?

Hold your funds in euros or dollars for example, let the Argentine peso devaluation occur, wait for things to settle down… and walla! You now have 4x’s as much purchasing power as your naive neighbors. See how that works?

This time around though, I believe people will have to jump out of any and all fiat currency dependent assets to avoid losing vast swaths of wealth, but I digress.

Luckily I wasn’t there in late 2001 when the stuff hit the fan, I simply witnessed the aftermath firsthand.

And sure, while I was there I certainly enjoyed my fair share of fine Malbec wines, regular rounds of golf with my very own kid caddy (who should have been in school), and grass-fed Filet Mignons for dimes on the dollar.

But I also saw mass protests and riots in the streets. Malnutrition in the countryside, young children recycling cardboard in the city’s promenades during the dark dead hours of the night, growing rampant inequality thanks to economic mismanagement, governmental graft, and social injustices deserving of criminal prosecution.

One major reason why I am writing this report: I saw the effects of the Argentine peso devaluation which changed a 1:1 peso parity with the U.S. dollar to nearly 4:1 in a matter of months. We have a similar situation developing throughout the western world at the moment. The aftermath and experiences I had in Latin America, they lead me on a road to write this report for you. Sadly today, the Argentine peso is again devaluing real time exponentially. Look at the latest hockey stick shape in the chart above. You don’t want to be on the wrong end of that.

I see the same things happening here in the U.S.A., although in slower motion. The main differences here are our gluttony of “that can’t happen here thinkers” many of which are in positions of power and influence. The fact that we’ve had it so good for so long means nothing.

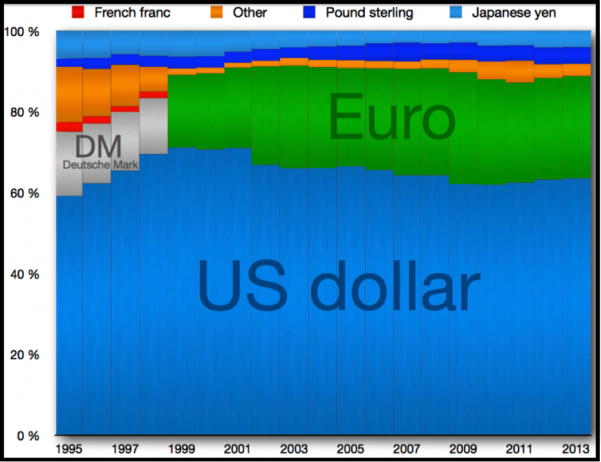

In real terms our economy has been going downhill since the turn of the millennium and nothing on the horizon gives me confidence that course is going to reverse. Sure, we may be the reserve currency of the world, but the BRIC nations are actively moving to subvert the influence of the dollar. Given the political chaos ongoing in the Middle East, it would not surprise me someday to see Saudi Arabia begin pricing their oil in other currencies.

Source: Wikipedia

Almost none of our well-to-do U.S. population has ever had to live through any periods of societal chaos. We continue to be conditioned with heavy propaganda, while most of us live hamster wheel lifestyles, interspliced with seemingly everlasting diversions and distractions. In other words, most people’s eyes are not on the ball and their psychological make-up will make it very hard to see increasing present-day threats for what they are.

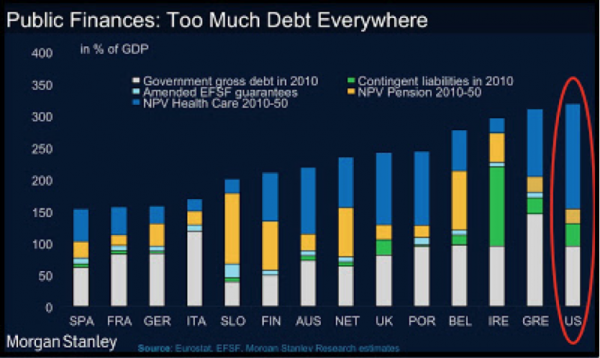

Look around, western governments and their private central bank partners have grossly mismanaged things and as per historic usual, the over-grown governments they together created, have now promised more goodies and supposed safety nets than they can ever deliver upon.

The overall population demographics are horrible as well in the U.S.A. The baby boomers haven’t saved near enough for their golden years, and now 10,000 of them are retiring every single day. These ever-growing retirees will eventually be looking to sell what nest eggs they do have in order to live off of.

Meanwhile people of my generation have only seen the purchasing power, or their real wage values, decrease in our medium incomes. Young people are graduating colleges with record student loan amounts, weak job prospects, and robotic automation threatening more and more future job prospects. In other words, young people today are not going to able to finance baby boomers on their deathbeds. It ain’t gonna happen!

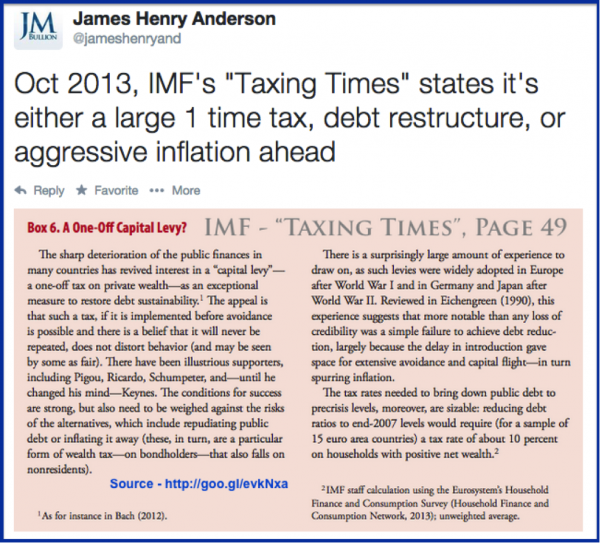

The long term answer to the issue of too much government debt and too many government entitlement programs which cannot be delivered upon is this… devaluate the buying power of the government fiat currency issued so that the government doesn’t default on its promises, but nominally pays them off in the weaker devalued currency units.

Here’s a billionaire hedge fund manager, in just 1 minute, corroborating what I am telling you is ahead for the U.S.A.’s current legal tender currency.

What I believe will happen, is the Federal Reserve (likely with the IMF leading the charge) is going to aggressively devalue the U.S. dollar (and other fiat currencies and central banks will follow suit as well). The U.S. dollar’s value has been all but obliterated over the last 100+ years having lost over 95% of it’s value since the central bank established itself here in 1913.

Fiat Currency – (n) currency, which derives its value from government regulation, force, and law. It differs from commodity money, which is based on a good, often a precious metal such as gold or silver, which has uses other than as a medium of exchange. The term derives from the Latin fiat (“let it be done”, “it shall be”).

Recently Nobel Peace winner, Joseph Stiglitz, arrogantly told European bankers that because of their Union they are not free when it comes to national financing while we in the U.S.A. cannot default thanks to our ongoing world reserve fiat currency, create Federal Reserve Notes out of thin air scheme.

What Stiglitz is stating boils down to this, “You’ll get your Federal government checks as promised, but there is no promise as to what the proceeds will actually buy you.”

Source: Twitter ➜ @JamesHenryAnd

In the current and coming financial atonement, I want to ensure that honest people have the option to not have their hard work stolen from “illustrious” establishment cronies and financial charlatans.

I aim to help you keep what you have produced and saved.

I wholeheartedly believe that in the coming years it will become glaringly obvious that gold bullion is the reserve money of the future ruling class, silver bullion is the reserve money for people seeking financial freedom ahead, fiat is the coveted currency of future peasants, while consumer debts are the soft ever-compounding shackles of slaves.

I will begin by giving you a brief, but insightful history of gold and silver.

We will then run through the fundamental drivers for silver and gold. I’m talking both metal’s basic supply and demand figures, covering the basic reasons for why people buy the shiny stuff and in what volumes and percentage terms they are currently doing so.

By doing this, we’ll get a feel for current market trends helping us shape an idea for where this is all going long term.

Let me warn you now.

There are things I won’t do in silver and gold investing. I’ll quickly explain to you the things I will not buy and why.

If you skip that section, you could lose everything.

Read it, take heed.

Then we’ll hammer into Bullion 101. What it is, how it operates.

We’ll cover some questions about which metal mix makes most sense for your needs. You may find out that you should simply own all gold. Maybe you’re a solo silver stacker? Like most people, you are probably going to find yourself somewhere in between, perhaps leading you to acquire both metals.

I am also going to teach you some of the important nuances between different coins, bars, and rounds. Stuff you have probably never learned nor thought about. Information about our potential futures, insights that may be of real benefit to know and act on right now.

There will be an important section on IRS buying and selling privacy with important details about what amounts of cash, which products in what quantities are required to be reported, and which products are completely exempt and private.

After that, we’ll take a look how you may choose the best silver and gold dealer(s), either online or locally.

Then we can discuss intelligent methods on how to take delivery, how to store and hide your stash, and eventually how to sell and ship your bullion safely.

Buckle up, it is time to begin.

The next article in our Beginners’ Guide to Buying Physical Bullion will discuss the history of silver and gold.