Now that you know a little bit more about precious metal investing, we are ready to discuss how precious metal investments compare to the most traditional investment — the stock market.

Many of the visitors on our website are already familiar with traditional investment vehicles like stocks, but aren’t so familiar with gold and silver.

The main difference between the two classes of investments is that stocks are classified as “equities,” meaning that the stockholder owns a portion of the company that issued the stock, while precious metals are classified as “commodities,” meaning that the owner of the metal holds a distinct, physical product.

Stockholders make money when the companies they own stock in increase profits or improve their business standing, resulting in an increased demand to own the company, and thus a rise in the price of their stock.

Precious metal investors make money when the demand for precious metal increases, thus causing the “spot price” of their metals to increase.

Historically, the stock market (as a whole) has significantly outperformed precious metal investments, which have been traditionally viewed as a hedge against inflation and risk (as opposed to a profit-seeking investment).

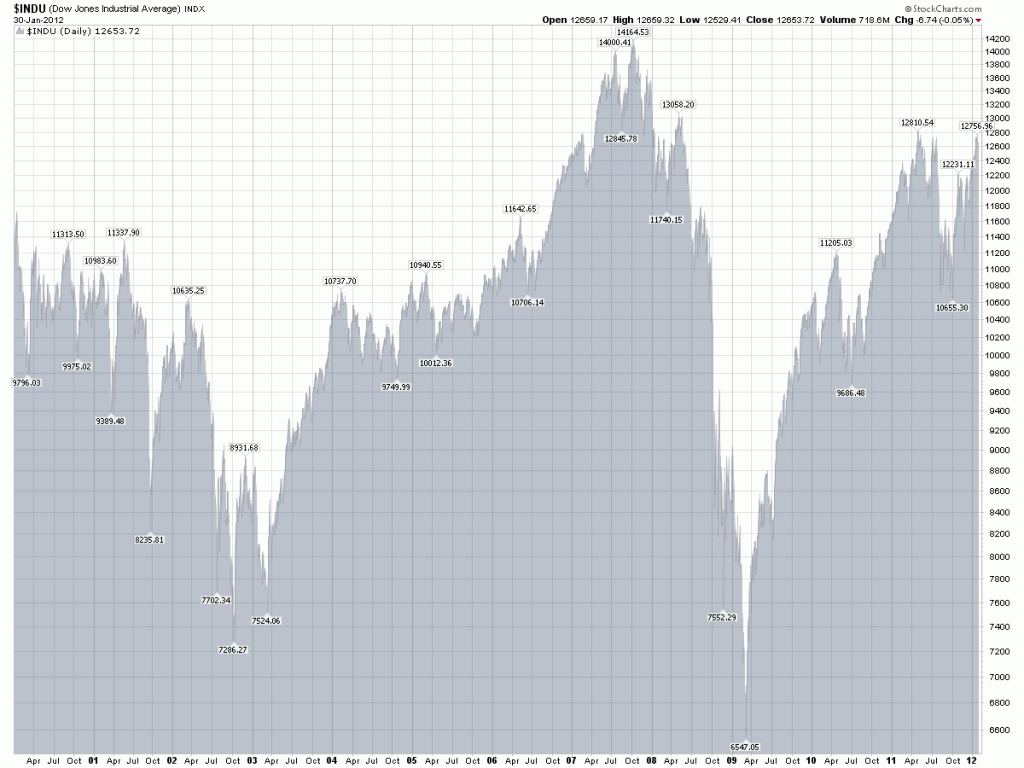

However, over the past 12 years that has changed in a big way, as both gold and silver have significantly outperformed the DJIA (Dow Jones Industrial Average), as you can see in the charts below. The first chart is the DJIA index for January 2000 to February 14th, 2012.

(Chart courtesy of StockCharts.com)

Above you can see that the DJIA opened January 2000 at ~11,700, and closed on February 14, 2012 at ~12,874, representing an almost exactly 10% total return* over 12 years. This pales in comparison to the DJIA’s historic ~4.8% per-year return*.

*These numbers are based strictly on share price, and do not account for dividends paid to shareholders during those years. If dividends are taken into account, the DJIA’s total return for the past 12 years is estimated closer to ~18% and the DJIA’s historical return is estimated closer to ~9.6% per-year.

Including dividends, we can estimate that the DJIA has returned a total of ~18% on an investment made in 2000 and held until the start of 2012. To make numbers simpler, let’s assume that an investor put $10,000 into the stock market in January 2000, and held the shares until present day. The investor’s stock would now be worth about $11,800.

So how have gold and silver performed in that same timeframe?

Here is the gold price chart for January 2000 to February 2012:

(Chart Courtesy of Kitco.com)

Gold opened 2000 at ~$282/ounce, and closed February 14, 2012 at ~$1,720/ounce, representing a total return of 510% over the 12-year period. So, if an investor had put $10,000 into physical gold at the start of 2000, and held the gold until present day, the investor would now hold ~$51,000 in gold.

How about silver? Here is the silver chart for January 2000 to February 2012:

(Chart Courtesy of Kitco.com)

Silver opened 2000 at ~$5.30/ounce, and closed February 14, 2012 at ~$33.60/ounce, representing a total return of ~534% over the 12-year period. So, if an investor had put $10,000 into physical silver at the start of 2000, and held the silver until present day, the investor would now hold ~$53,400 in silver.

Let’s compare the final results on a $10,000 investment over 12 years:

As we mentioned earlier in the article, the DJIA has historically (for 70+ years) outperformed gold and silver significantly, so what has changed?

Well, the main causes of this trend reversal are:

While there is certainly a place in any portfolio for traditional stocks, the above factors don’t appear to be close to working themselves out, so we see gold and silver as a smarter and safer play than the stock market (at the present date).