Fifty gram silver bars may be an option for silver investors that are on a tight budget or that want to make small, incremental silver purchases. Because 50 grams equates to approximately 1.76 ounces, these silver bars are quite affordable at current silver prices and may make it easier some those with less investment capital be begin building a stack.

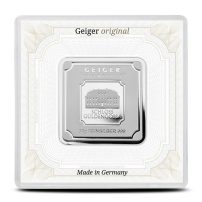

Some of the more well-known fabricators that produce 50 gram silver bars are Pamp Suisse and Geiger. These silver bars do not appear to be as popular as 1 oz silver bars and therefore selections of these bars may be significantly smaller than 1 oz or 5 oz silver bars.

For investors looking to acquire as much silver as possible, these silver bars may not be the best way to go. Due to their smaller size, these silver bars may have a higher premium attached to the. Because of this potentially higher premium, you will get a smaller amount of actual silver bullion for your dollar. For those looking to really build a stack, a great deal of money can potentially be saved by purchasing larger silver bars that may potentially have much smaller premiums attached to them.

Because 50 gram silver bars contain .999 percent fine silver, their value is determined by the current spot silver price. If you decide to sell your 50 gram silver bars, the money you get will be the spot silver price (factored by ounce) minus the buyer’s discount. In other words, when you sell your silver, you will likely receive a little less than the actual spot silver price per ounce. This is because dealers typically buy silver below the spot silver price and sell silver for more than the spot silver price. This is known as the dealer markup, or dealer spread. These spreads can vary greatly by product, with some silver bars having very minimal dealer spreads while some silver coins may have spreads of several dollars or more.

These bars are not the most popular, but there is usually a market for them. If you wish to sell them to a dealer, the dealer will typically have you send the pertinent information such as year and type and then will quote you a purchase price.

Because the 50 gram silver bar is a relatively small silver bar, they do give you an easy way to dollar-cost-average your purchases. For example, if you set up a budget to spend $50 per week on silver bullion, you could (at current prices) buy a 50 gram bar each week. This would allow you to potentially buy silver bars on any further dips in price. Doing this over time may potentially lower your overall cost basis, helping you to get more silver for your money.

Because of their small size, 50 gram silver bars can be easily stored at home in a safe or in a hidden, secure location. They can also be stored in a bank safe deposit box or in a depository. If you want to have some silver available to you at all times, then these bars may be a good choice because they are small, easy to store and transportable.

If you are brand new to silver investing or have a limited budget, the 50 gram silver bar may be a way for you to begin investing. If you have a larger budget, however, other products may potentially be a better value.