Free Gold Price Widget For Your Website

This feature is only supported in the desktop browsers. Please visit this page in your desktop browser to retrieve the widget.

Share live gold prices with your website followers or on your blog, using our free gold price widget. To get started, please select one of the size dimensions from the drop-down menu below, and copy the code from the Widget Code text box and paste it into the desired position in your page. If you have any trouble, please contact us at support@jmbullion.com.

Widget Preview

Widget Code

Gold Prices in Swiss Francs

Gold is a key precious metal that is traded all over the world. Gold is often quoted in U.S. Dollars per ounce, but can be quoted in and transacted in any currency. Gold prices are quoted in prices per ounce, gram and kilo. If you are in Switzerland, gold would be quoted in the local currency.

The Swiss Franc is the official currency of Switzerland and Liechtenstein and is also considered good, legal tender in the Italian exclave Campione d’Italia. Swiss currency comes from two sources: The Swiss National Bank issues the country’s banknotes while the Swissmint issues the country’s coinage.

The Swiss Franc is a favorite among currency traders, and the currency is widely considered to be a safe-haven. The Swiss Government and economy are considered to be extremely stable and reliable, making the currency attractive during times of economic or geopolitical crises. For a long period of time, Swiss law dictated that a large percentage of the nation’s currency be backed in gold. This law was repealed in 2000. In the year 2014, the country voted down a proposal to once again require backing in gold. The Swiss Gold Initiative proposed that 20 percent of the currency be backed by gold.

Gold Pricing in Swiss Francs

Gold can be quoted and transacted in Swiss Francs by the ounce, gram or kilo. The global gold market is in a constant state of price discovery, and prices can have significant swings as well as periods of relative quiet.

The price of gold can be affected by numerous factors. Some of the primary factors that can potentially influence the price of gold include central bank activity, interest rates, currency markets and inflation.

The Swissmint

Swissmint is the official mint of Switzerland. The mint is located in the capital city of Bern, and is responsible for producing both Swiss circulation coinage as well as bullion coins. The mint also produces medals and commemorative coins. The mint is an agency of the Swiss Government.

The Swiss 20 Francs Gold Coin is a fine example of Swiss quality and craftsmanship. These coins were struck at the Bern Mint from 1897 and 1935, with additional runs in 1947 and 1949. The coin’s obverse features an image of a woman, widely regarded to be symbolic of Switzerland. The coin’s reverse features a rendition of a Swiss shield surrounded by oak leaves as well as the coin’s face value and minting year.

The Swiss National Bank

The Swiss National Bank is the central bank of Switzerland. The central bank is in charge of the country’s monetary policy, and as part of its mandate it seeks to achieve price stability and to foster economic growth. The Swiss National Bank is the exclusive issuer of the country’s banknotes, and is also in charge of coin distribution. According to Forbes, Switzerland is one of the largest holders of gold bullion with 1040 tons, the largest amount of gold per capita in the world.

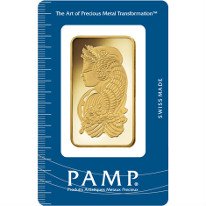

Credit Suisse

Credit Suisse is a multinational financial services firm located in Zurich. The company was originally founded to help develop a rail system. The Credit Suisse refinery has a reputation for producing some of the finest gold bars in the world, including gold bars that are considered to be “good delivery.” The 1 Ounce Credit Suisse Gold Bar (New with Assay) is a great example of the quality and craftsmanship that Credit Suisse is known for.

Valcambi Suisse

Valcambi Suisse is another Swiss-based refinery with an excellent reputation. This refiner has been in business for 54 years, and is located in the city of Balerna. The 50 Gram Valcambi Gold Combibar (New with Assay) is a great example of the quality and design work of the Valcambi brand.

The Swiss Economy

The Swiss economy is considered to be one of the most stable in the world and the nation has achieved one of the highest per capita incomes in the world. The country has some diversity in its economy, and major areas of concentration are in watch making, agriculture, banking and tourism.

Swiss banking is highly popular due to Swiss banking laws and the nation’s commitment to privacy and professionalism.

World Gold Prices

- Arab Emirates Gold Price

- Australia Gold Price

- Brazil Gold Price

- Canada Gold Price

- Chile Gold Price

- China Gold Price

- Czech Republic Gold Price

- Denmark Gold Price

- Europe Gold Price

- Hong Kong Gold Price

- Hungary Gold Price

- India Gold Price

- Indonesia Gold Price

- Israel Gold Price

- Japan Gold Price

- Malaysia Gold Price

- Mexico Gold Price

- New Zealand Gold Price

- Norway Gold Price

- Pakistan Gold Price

- Philippines Gold Price

- Poland Gold Price

- Russia Gold Price

- Singapore Gold Price

- South Africa Gold Price

- South Korea Gold Price

- Sweden Gold Price

- Switzerland Gold Price

- Taiwan Gold Price

- Thailand Gold Price

- Turkey Gold Price

- United Kingdom Gold Price

- United States Gold Price