What a difference a month makes! Apparently, the Bureau of Labor Services (BLS) is reporting a whopping 517,000 jobs created for January 2023, which is the highest number in about 6 months. That sounds like an awesome way to start off the year, right?

Except, the jobs report is not nearly what the media thinks it is. And it is time to slow the roll of the media that has not spent much time looking at the fine print. Except for the Chief Economist for Bloomberg, Anna Wong, who had the following to say on the non-farm payrolls report (NFP).

“The January jobs report showed extremely robust growth, higher than the highest estimate in the Bloomberg survey. If it seems too good to be true, that’s because it is too good to be true — the gain is mostly due to seasonal factors and revisions to past data. The Fed likely won’t place too much weight on this report in formulating policy.”

The Data

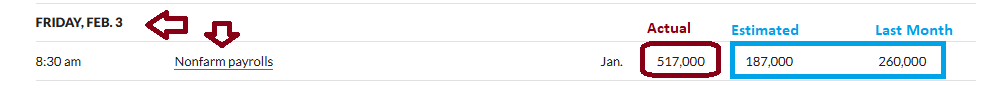

Here is the data from the ticker tape:

We can see that the 517,000 increase in jobs was roughly 3x what the economists expected to happen, per the Wall Street Journal survey of economists. Further, the increase was 2x the increase in jobs that the BLS reported for December’s results.

On the surface, it looks like companies decided to hire a ton of new workers for the new year. This sounds encouraging until we realize that none of the economic fundamentals in the economic report to robust growth that would support such fantastic new job creation. So, it seemed a bit rosy on the surface, and thankfully we have great analysts that provide deeper analysis for us.

Yearly Adjustments

January is typically a rosier month for job numbers every year due to BLS and NAICS seasonal adjustments to the number. This adjustment is conducted yearly and applied to January to refine the number accuracy.

In ADDITION to that seasonal adjustment, the BLS also decided to change the framework for how they count the numbers. In the past year, it has become apparent that the ADP private payroll report and the Household survey of actual jobs conducted by the BLS have been pointing to a much more pessimistic view of job creation than the BLS establishment survey. I will explain all that next and see the chart below.

ADP runs private payrolls for many companies and is considered a great look into ACTUAL company payroll data across the economy. On February 1st, they forecasted a meager 106,000 job increase, less than half of what the increase they reported in December. Remember, they use actual payroll data and therefore not a survey, so they don’t have to make any ‘seasonal’ adjustments.

Second, the BLS does a household survey in which actual households report their increase in employment. That part of the BLS report every month had more closely aligned with private payroll provider ADP and appeared to contradict the establishment survey from the BLS.

Wait, the BLS has TWO surveys? Yep, they do. The establishment survey is from the industry and is an estimate of jobs, not a physical count from ADP or actual households. The establishment survey is the number; however, that is always reported in the media. And so most serious labor analysts do not prefer the establishment survey because they consider the precision to be lower. When in fact, it is.

So back to the BLS framework change for the establishment survey – to close the ‘gap’ between that survey and the others, they made a one-time, retroactive adjustment to ALL of their job numbers in the establishment report. And wouldn’t you know, that appears to have solved the differences in data between the BLS’ own establishment and household surveys, as WELL as the difference between the BLS establishment survey and ADP private payroll numbers.

Did you get all that?

If you didn’t, don’t worry too much. Basically, it means taking the mainstream media reporting on jobs with a grain of salt and waiting for the monthly revisions to come, as they always do, which will eventually reduce the increases in jobs to a more reasonable number.

However, at this point I personally consider the BLS establishment survey to be a somewhat phantom number that is not reliant on fully accurate jobs data and has been modified so much as to be basically meaningless. Yes, I will probably be labeled a quack for saying that. But I have two other more accurate reports on which to base my view.

There is More – Part Time Jobs

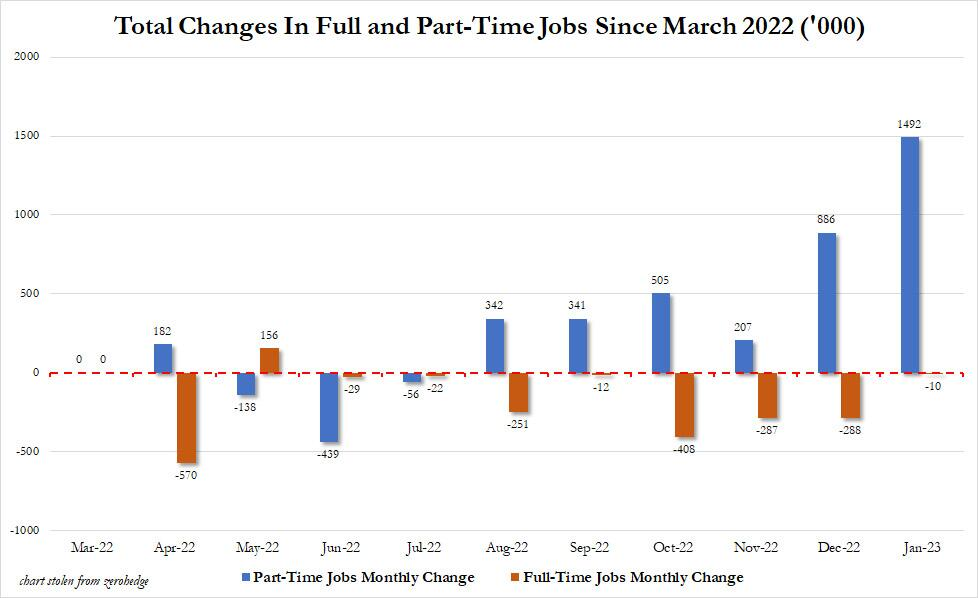

In addition to all of that data fiddling above, we also have another reason to doubt the overall robustness of the new job numbers. The BLS’s own data, compiled by independent analysts, show that part-time jobs are SURGING while full-time jobs are receding. The following chart shows the action.

What we see in the data is that people are making up for the lack of full-time jobs by taking two part-time ones. So even though we have more jobs, we do not have as many more people gainfully employed as the numbers indicate on the surface. Further, we also do not have more people employed in full-time roles where their income levels can support a household.

We have more people taking multiple part-time work which forces consumers to make hard choices on reducing spending at a time in which price inflation over the last year has risen substantially. It has been a tough year for many in the economy, unfortunately.

Final Thoughts

People reading this article may think I am being very picky about the data. Well, I am. As a former auditor, I have this silly thing about accuracy with data. While I believe the BLS data is helpful, the top-line prints are rarely the full truth. The BLS does provide a lot of nuggets about what is really going on; we just must find them. Thankfully, we have breadcrumbs along the way to guide us.

The concern is that the selloff in markets, including precious metals, occurred due to some lack of insight from market pundits as to what is really going on with jobs. Payroll reports are one of the single biggest factors used by market analysts to make trades, so if they aren’t correct then Mr. Market could misprice some assets over others.

Chiefly, gold and silver are taking it on the chin right now when there is absolutely no reason they actually should. I suppose that creates a buying opportunity for metals investors that they shouldn’t pass up. Because this price weakness will not be around forever, once it is clear the job numbers don’t reflect economic reality for the workers or their budgets. That will be reflected in other data coming out this month on retail, auto, and home sales along with things like credit card balances.

Coin of the Week

I am going to surprise you this week and discuss cast bars. I love the look of a hand-cast bar and the physical stamp on the bar, such as what we see with the Germania Mint cast silver bar. These are crafted with care, come in limited quantities, and command higher premiums than regular machine-stamped bars. If you are looking for something different for your collection and can afford a bit more premium to get a unique design, then you may want to think about adding a cast bar to your collection. I certainly have.