As suspected, the gold and silver prices are going down now after a swift rise following bank failures in the spring. Generally gold and silver do not trade higher on the American exchange unless there is a reason to keep them there.

For the most part, prices are determined by the whims of many traders with many objectives. One is speculating on gold and silver price movements, one is hedging price risk on existing metal stocks, and one is capturing value when financial calamities drive up prices.

In the current scenario, the market is pricing in the current macro environment which seems to have settled a bit since spring when we had several bank failures. Traders are fickle and memories are short. But we are not out of the woods yet, so I am using the pullback to increase my stack.

Gold and Silver Analysis

Gold and silver are in a decided downtrend dating back to last week. The frightening news of bank failures has been replaced with talk of a debt ceiling deal. The debt ceiling governs how much debt the country can take on financially and must be approved. Followers of this aspect of our economy will note that the debt ceiling is always raised and is therefore not a hard cap by any measure.

In fact, the debate about debt ceiling increases is theatre for the people while Congress continues to run the printing presses. While people blame the Federal Reserve for the recent era of profligate spending, none of it could have occurred without the consent of the governed under the management of Congress. We all have blame in it, and I do not see any other way to look at it.

A recent documentary from PBS Frontline called The Age of Easy Money does a great job outlining the problems with too much money and credit too fast. The summary of the video is that the profligate spending of the past must end, and it is the responsibility of the people to make those changes. The video downplays the role of the Fed in these policies, which I do not agree with. Of course, they were involved, and in fact, the testimony of Fed chairmen in Congress has often outlined their flawed view on the state of the economy.

The central bank of the nation must agree to some accountability. However, real financial reform belongs to us and not anyone else. We must tell our government what we want them to do. But we cannot do that if we do not understand all the important aspects of the problem. It is time we discussed this spending and what to do about it in real, serious terms. Because if we do not, then our economy is going to go off the deep end and we will have a lot of room for cleaning up a big financial mess.

Gold and silver are trading down within the trend, both below the short-term moving averages and above the long-term. My view is that this is still positive and should not be a major concern, largely because I think the news cycle is going to provide the market with plenty of ammunition. However, the derivative markets are owned by the traders, and they are a fickle bunch. While the 24/7 new cycle affects all markets including precious metals, the reality is that the general investor does not want to recognize the value of precious metals until they must. Think back last week to my comments on the truth and the stages of acceptance of it.

The volume indicator highlighted on the bottom of the chart indicates a fading amount of open interest contracts on the COMEX market. Traders have reacted to the recent bank failures by moving their positions, and now we are in a waiting game for the next big news event. Time will tell how much fade we get, but my prediction going forward is this. While gold and silver may trade down from time to time, on the longer-term chart they are going to continue to make higher highs and higher lows until the debt and currency issues are resolved. Time will tell if I am right.

The Macro View

Retail crime is becoming an issue. Stores have been vandalized in cities where police presence has been reduced, or in areas where local authorities have loosened penalties on property crime. The following quotes from CNBC illustrate the problem.

“The country has a retail theft problem,” Home Depot CFO Richard McPhail said on a call with CNBC on Tuesday after its earnings. “We’re confident in our ability to mitigate and blunt that pressure, but that pressure certainly exists out there.”

Target said organized retail crime will reach $500 million more in stolen and lost merchandise this year compared with a year ago. On its earnings call, Target CEO Brian Cornell said retail theft is “a worsening trend that emerged last year.”

While retail crime has always been an issue, the environment has changed substantially. On one hand, local governments are stressed about increasing domestic crime rates. Crime rates have largely been contained to lower-income areas in the past. But crimes are now migrating to cities like Beverly Hills and have drawn the interest of the well-heeled.

Nobody is truly safe from theft and other crimes of opportunity now. After all, when people are desperate for food and shelter, they will often do anything to relieve the pressure. I expect thefts to increase going forward. According to SILive.com, thefts have gone up around the country.

“The significant spike in vehicle thefts reported on Staten Island last year serves as a microcosm of a much larger national issue, with over 1 million cars stolen across the United States in 2022, the highest number in over a decade, according to data.

Earlier this month, the National Insurance Crime Bureau (NICB) released the results of a new data analysis, finding that an estimated 1,001,967 vehicle thefts occurred across the country last year, with New York reporting the ninth-most stolen cars of any state.

“We are seeing vehicle theft numbers that we haven’t seen in nearly 15 years, and there is very little deterrent to stop criminals from committing these acts, as they are just property crimes, like shoplifting,” said David J. Glawe, president and CEO of the NICB.”

I expect to see crimes of opportunity increase as economic outcomes worsen, particularly for younger generations that simply do not have access to cushy high-wage jobs we were used to in the past. Companies are tightening their belt and the difference must be made up somewhere. With the government maxed out on spending now, we are going to have to provide private market solutions to the problem to resolve it. Spending any more government money at this point just makes the coming recession even worse.

Story of the Week

I recently asked my Twitter audience whether they were buying the dip in silver prices. Here are a few of the responses.

This follower likes silver! That is quite a stack in just one purchase.

Another investor responded with 70 ounces purchase on the dip.

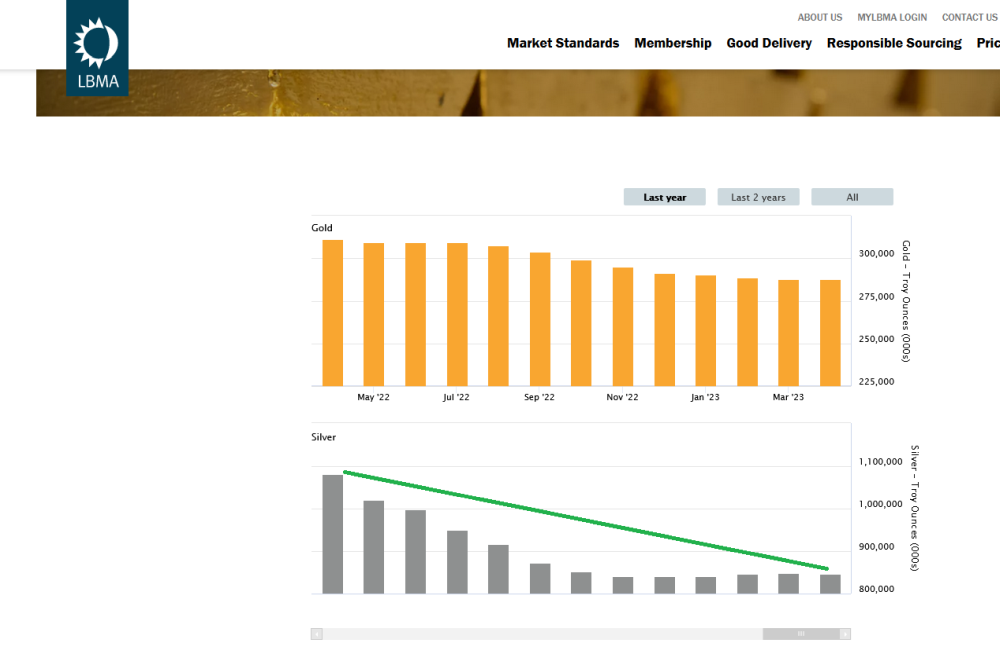

And Silver Surfer added that he was investing in silver like ‘wildfire’. The silver investment community remains strong and is buying the dip. This appears to coincide with the international trend of taking silver off the major exchanges dating back to the Silversqueeze event a couple of years ago. Here is the chart.

Silver has been coming off the COMEX dating back the last couple of years. Silver is used heavily in many industries, which you can see in a previous article here. That demand has been steadily pulling down existing stockpiles for quite some time.

The London market is also seeing heavy redemptions in silver that do not react to short-term price changes. Demand in silver is simply not going to slow down.

Executive Summary

Speculator trading on the precious metals has driven down the price as traders play short-term momentum on the way down. Pullbacks are normal but physical demand continues to increase past what the industry can provide, draining exchanges.

Non-violent crime such as theft is increasing as the nation suffers from high inflation and declining asset prices. People need to eat and pay the bills and will do what they need to do in tough times. Porch pirates are back taking packages as well. It is just a sign of the times, and I suggest you take action to secure your personal possessions just to be safe.

Silver demand is simply not stopping. Though not reflected in spot prices, that is largely irrelevant at this point. Prices have nothing to do with physical demand now. Remember not to focus on price, but instead on stocks and flows in the system. Stocks are low, flows are very high, and the future is very bright for silver investors.

Coin of the Week

On the menu, today is silver, of course! This 1 oz Lady Liberty round from SilverTowne reminds me of the reason why we are all here, liberty. Without it, nothing else really matters. Silver is freedom, after all.