I often get this question, and it is an interesting one. How much gold does China really have? And does it matter?

The answer to the latter question is a resounding yes! Of course, we want to know how much gold China has. After all, they are our main trading partner, and many would also say competitors in the open market. It makes complete sense when we consider how important gold is becoming to central bank stability, to compare the gold reserves of the various countries with those competing for central banks and currencies.

The answer to the question of how much gold China has, however, is a bit more difficult to answer. You see, we don’t really know exactly. We can hazard some educated guesses in this article, which is what we will do next. However, China has done a really good job keeping this information out of the hands of analysts in the West.

Undoubtedly, this is a move to keep China’s internal finances largely quiet. The Chinese are not well known for the integrity of their economic data. And that is largely on purpose, I believe. After all, what good does it do to let the world know your financial positioning when you are busy building what will soon become the largest economy on earth, buoyed by the largest trading network ever created in the Belt and Road Initiative?

The Chinese are no fools and plan for the long term. No longer likely to sneak up on the world, the Chinese still don’t want to broadcast their plans to the Western world. That is why, I believe, they are fibbing on their gold reserves. I believe the country has much more available to them than they are letting on, and the following is going to be a fun missive on figuring out how much they really have.

The Data

It is well known in gold market circles that the Chinese don’t let precious metals leave their country very often. They have absorbed all their internal production for many years. And while they have a publicly traded market in the Shanghai Gold Exchange with a substantial amount of physical settlement, we had to hunt for data on how much of that gold ever leaves their shores. Though export restrictions limit how much gold can leave and who can facilitate it to a very small number of entities, as you will see in a moment.

We do, however, have some supporting data that we can use to make a well-constructed case for the range of gold the Chinese state may possess. We will look at that data here and make some educated guesses on where the Chinese stand and how that may impact the US going forward.

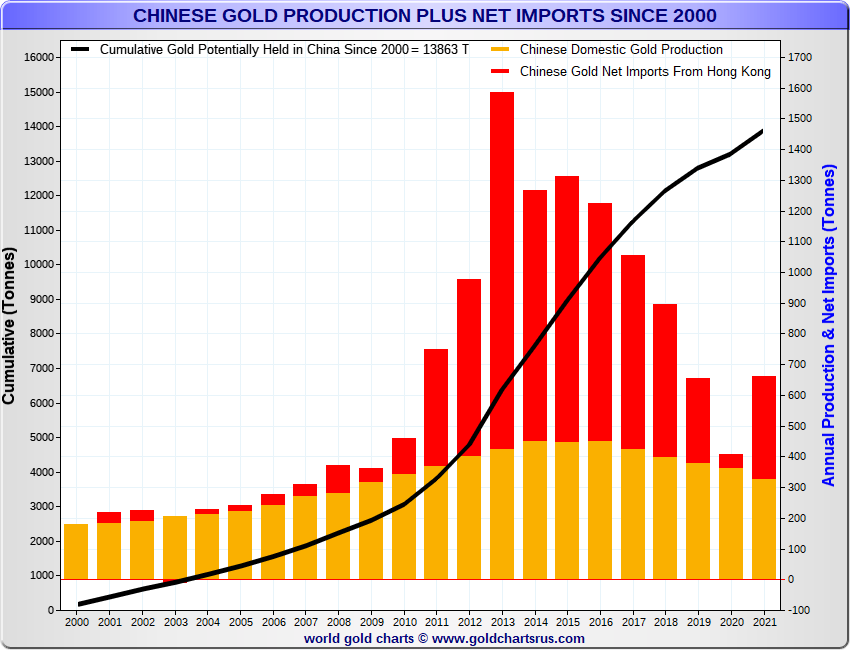

The chart above shows the total amount of gold produced by the Chinese, plus the gold withdrawn from the Shanghai Gold Exchange (SGE). SGE withdrawals are shown to indicate how much additional gold may be taken in by the Chinese government, the financial sector, and local traders and merchants. Not all withdrawals add to above-ground reserves as much includes recycled gold as well. But most stays in the country as the Chinese have strictly limited how much and what type of gold can leave the country.

However, the Shanghai Gold Exchange sits in a free trade zone which does allow exports. The main export partners are Hong Kong, India, and the UK mostly for the gold trade per the UN COMTRADE tool. Per the UN, China exported just 53 ton of gold to the rest of the world in 2021.

So, as we can see, most gold that makes it into China stays there and doesn’t come out. Meaning, while China exports very little gold to the rest of the world, they do import quite a bit, see the next chart.

Most of these imports can be added to reserves. And by that, I mean what the Chinese economy and central bank have had available to them, with the understanding some of the gold could have been used in the production of commercial products. Most gold around the world; however, is held in investable form including bars, coins, and jewelry.

Final Thoughts

It is quite possible that the Chinese could have somewhere around 20,000 tons of gold available in their commercial market, either as central bank reserves or commercial investment products. Let’s use the following analysis as a starting point for the analysis.

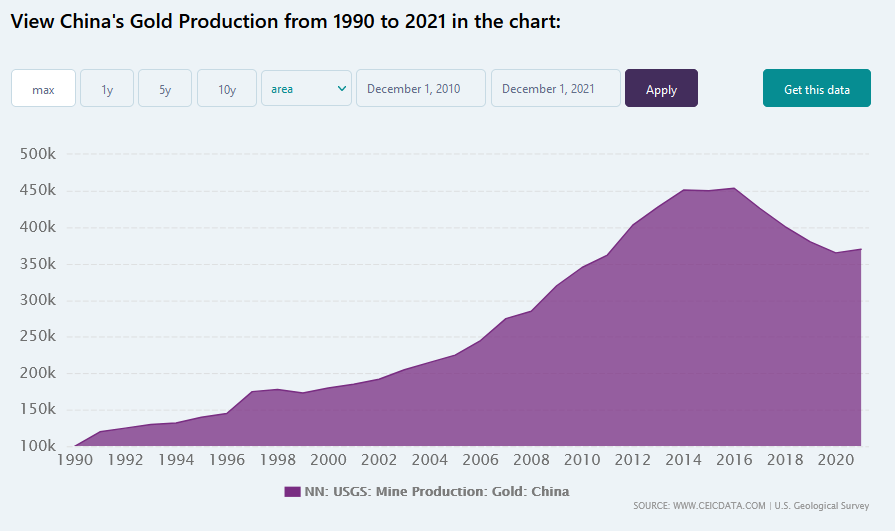

China has been a net importer of gold since the 90s. The following chart shows their gold production dating back to the 90s. Their production has rapidly increased over the time span, leading the world with 370 tons of gold in the most recent year, and peaking at over 400 tons per year in the middle of the decade. That would yield over 8000 tons over 30 years, per my calculations.

Add in the 2500 tons the Chinese people had in jewelry form, as estimated by the World Gold Council, and we are over 10,000 tons.

Imports amounted to about 7200 tons from 2000 to 2021, and you can add a few more tons from before that dating back to the 90s. So, say around 8000 tons as a good guestimate?

Lastly, China reports their official gold reserves are 1980 tons. Add all of that up, and you have just over 20,000 tons, albeit with a very imperfect set of data.

We know for example not all gold imported would have been purchased or used by the central bank. Some of it would be used for industrial purposes in computing and quite a bit of it for jewelry. However, most of that gold will be sitting in coin and bar form as an investment product and the likely owner of most of it is the PBOC or related government entities.

The exercise itself was fun, and it wouldn’t be surprising if China eventually admitted to the world that it had far more reserves than reported at 1980 tons. It may be a good time to do this if and when China needs to support its Yuan currency by increasing officially reported gold reserves. We will see what happens in the future.

Coin of the Week

If you can’t beat them, then we can always join them. If China has more gold reserves, let’s make a concerted effort here in the US to take some of that gold off of their hands and into our personal reserves.

I recommend the China Gold Panda coin. Truth be told, I like the design more than most other sovereign coins. Pandas are friendly and will appeal to kids who are just getting into the metals. The back side is simple, but an effective brand for China and will also appeal to many coin collectors. The coins are very well known and traded, and you can usually find them just about anywhere gold is sold including here at JM Bullion.

They are an interesting option to add to your own collection of government-minted coins, and one I believe should not be ignored. China produces lots of gold every year, and it would be a waste to ignore what is a very solid entry into the sovereign gold coin market. You only have so many good options in the space, so you might consider adding one to your collection.