Here we are again, deciding on whether we want to raise the national debt ceiling or not. I am being slightly flippant here, on purpose, because we never seem to vote for fiscal restraint – at least our Congress never seems to. These types of ‘trend events’ in our national financial well-being always seem to pass without much fanfare. We just issue more debt and move on about our day. This time, the Congressional Budget Office (CBO) is sounding an alarm. The only question is, does anyone hear it?

Does Debt Really Matter?

The picture above is from our Federal Reserve, St. Louis office. Each region of the Fed tends to do its own research and it adds to the FRED database that we can all view. This particular chart shows our debt to GDP position. Meaning, how much debt we take on, relative to our yearly national economic output, as a measure of our national solvency. In other words, how much risk is the US of going broke?

Many people would say since we owe the debt to ourselves, we shouldn’t ever worry about it. This is an oversimplification, as the process to service the debt has laws attached that ascribe responsibilities to paying it. Further, we don’t just owe ourselves because many other countries have been buying our debt for years! So, the only other way is to ‘default’, and if we do, then the rest of the world would likely push us off the top of the mountain from a trading and currency perspective.

This means the debt is a danger to the dollar as the world reserve currency and further to whether the US has any credit with other nations and their banks. Simply put, our borrowing costs and financial flexibility can be severely reduced in the event we default on our national debt.

We don’t exist in a vacuum, and the countries such as China, which also owns a bunch of our national debt, aren’t going to be happy if we default or devalue it and cause losses for our foreign bondholders. More on that in just a moment, but first let’s look at the central bank’s position on the matter.

The Fed’s Position

The picture above from the same St. Louis branch of the Fed seems to indicate that treasury yields go down when GDP goes down. The article author makes the conclusion that we can run deficits forever, because we can simply print more new lower yield (aka lower interest expense) debt to replace the old debt, in the case we experience a downturn.

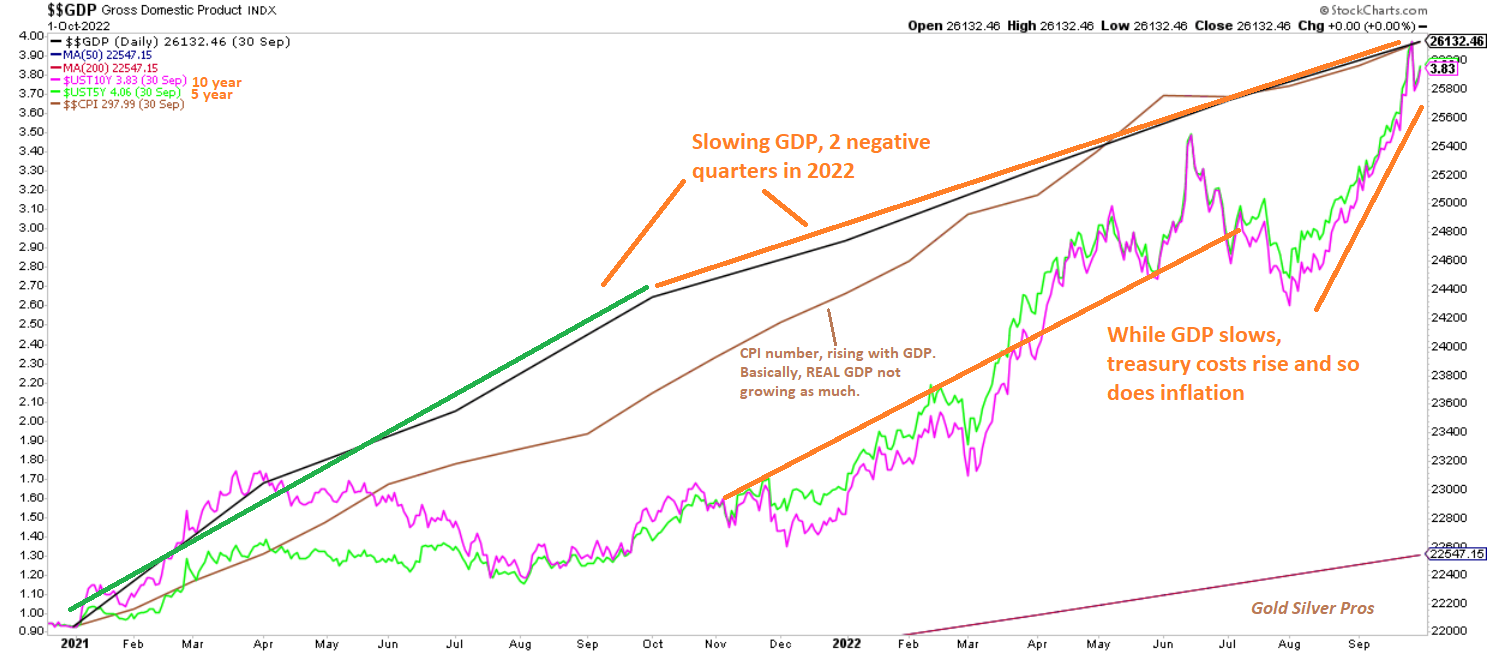

The article doesn’t specify this, but seems to intimate by the chart and the language presented, that this system will never break. Except, it might be breaking right now. Let’s look at the reality of what just happened last year when the broad markets sold off. Treasury yields ROSE when GDP printed two consecutive quarters of negative growth.

Now this could be an anomaly, but I am not thinking so this time. It was clear in 2022 that the rest of the world did not want to buy our debt during the liquidity selloff going on in the stock markets, and during a year in which real GDP was negative for 2 straight quarters. The chart below shows the reversal of the trend during 2022.

What About Our Debt in 2022

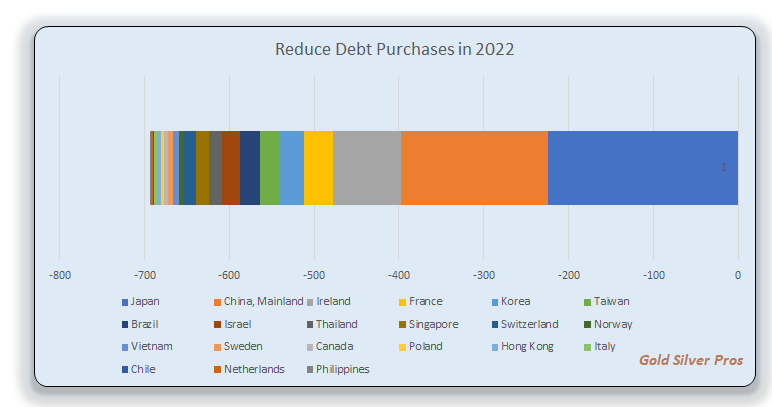

What happened to our debt levels in 2022? Were people more or less interested in purchasing US treasuries during a time in which our stock markets suffered a 20% selloff and our GDP slowed down? I put together the following graphic, based upon data from the Treasury on foreign holders of treasuries. Notice how our biggest trading partners, and debt holders, deleveraged out of our debt last year.

Or in tabular format, the largest dumpers of US treasuries, net of all purchases, in the last year are shown. Overall, per the Treasury, foreign debt purchases dropped $425.9 billion in 2022.

It appears as though while foreign countries still use our debt, they are deleveraging, ‘net, net’ of overall world purchases, with several of our key trading partners leading the way! There are some specific reasons why this is happening, which I will save for a future article.

Carmen Reinhart and Kenneth Rogoff’s Research

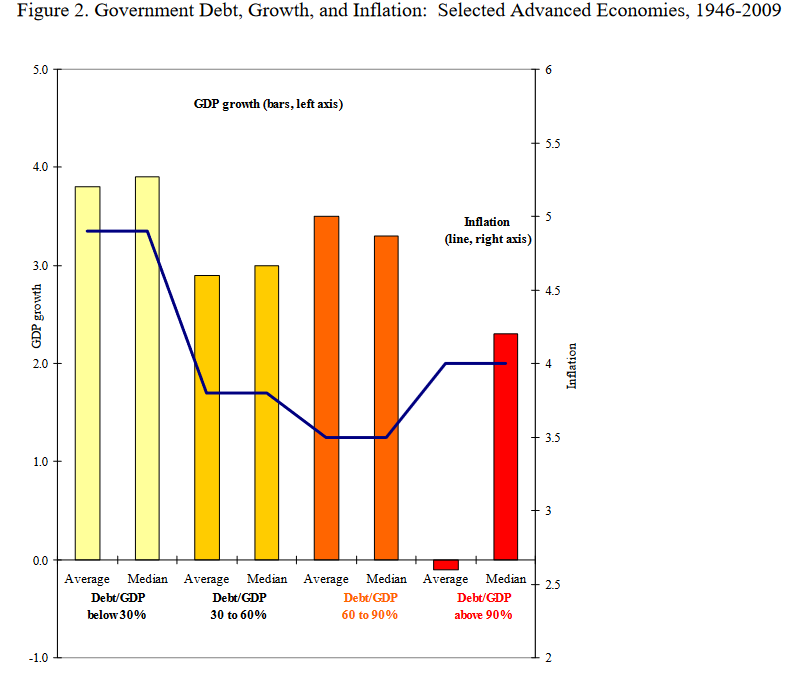

A funny thing happened on the way to work this morning. I remembered the research done by two highly respected analysts regarding debt and GDP. In particular, their 2008-2011 works in the form of research papers and eventually the book This Time Is Different: Eight Centuries of Financial Folly outlined what happens to countries that surpass 90% debt level to their national economic output, the GDP.

The following chart shows about 60 years of results for major advanced economies when debt reached 90% of GDP. The researchers pointed out that countries would experience higher inflation and slowing output (measured as declining GDP numbers). See below.

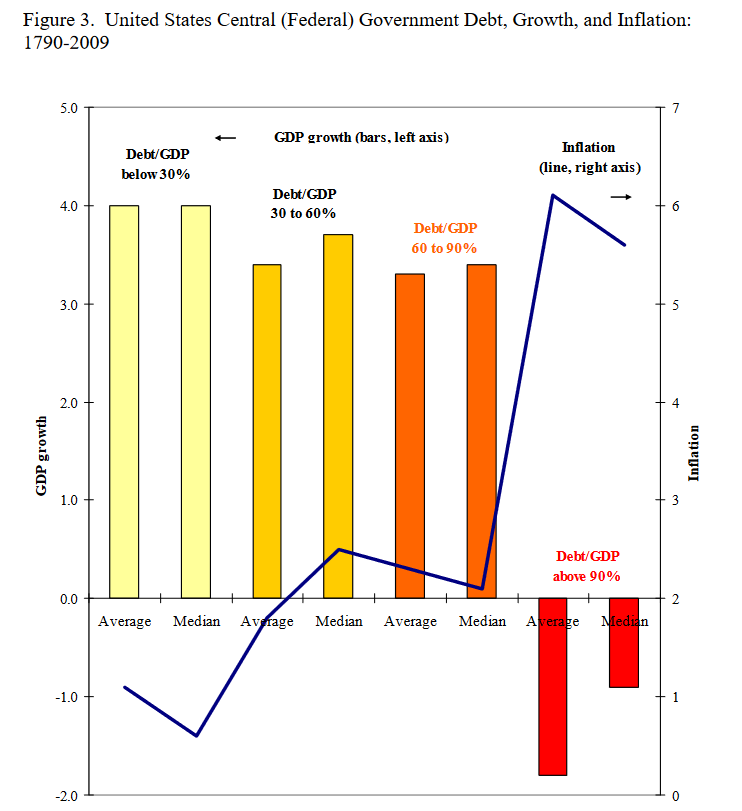

An even more interesting chart is the US-specific reaction to 90% of GDP over that of their advanced economic peers. It seems to indicate the world is MORE sensitive to (or affected by) higher debt levels of the US, having the dollar as a world reserve currency. See below.

It’s likely the rest of the world knows full well what a debt default in the US could mean for the economic fortunes of everyone else. In other words, all eyes are on us until the fat lady has sung and the final curtain has drawn on the US dollar economic system.

Final Thoughts

While I was purposefully being flippant to start the article, I would like to end on a slightly more serious note. It appears as though the conventional wisdom on debt and its impact on the US economy may not be entirely accurate. Meaning, while researchers have studied other economies going through a debt-based financial reset, this is the first time the US is doing it as a pure fiat world currency. So, it’s no surprise that current bureaucrats are more confident that the US will survive than other countries have in similar past situations.

But do they have reason to be? Will the world continue to support our economic shenanigans? Only time will tell, but perhaps the data above is giving us a warning. Because if this trend continues, then we may have found our answer to the question of does the debt really matter.

ROB KIENTZ IS A PRECIOUS METALS INDUSTRY EXPERT WITH OVER TWENTY YEARS OF INVESTMENT EXPERIENCE IN BOND, STOCK, REAL ESTATE, COMMODITIES, FOREX, AND PRECIOUS METALS MARKETS.