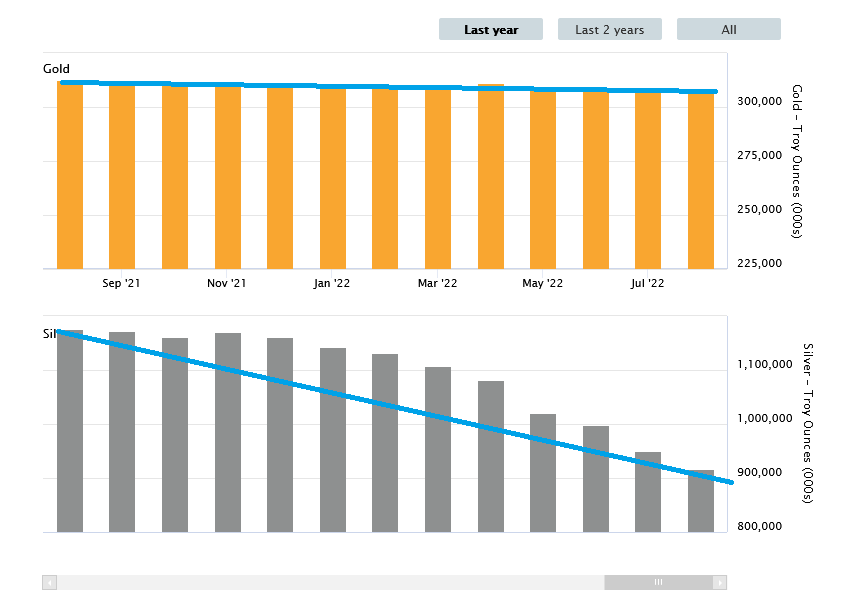

In my first article at JM Bullion, I pointed out the declining silver inventories in the Western precious metals markets. I used the following chart to illustrate how, since the silver squeeze movement occurring from Jan to February of 2021, market players have been moving silver out of the COMEX warehouses.

Western Silver Inventories

To recap the previous article, the nearly two-year movement of silver off of the COMEX, and now the LBMA, is confirming the argument that mine supply is not keeping up. See the chart below from the LBMA website.

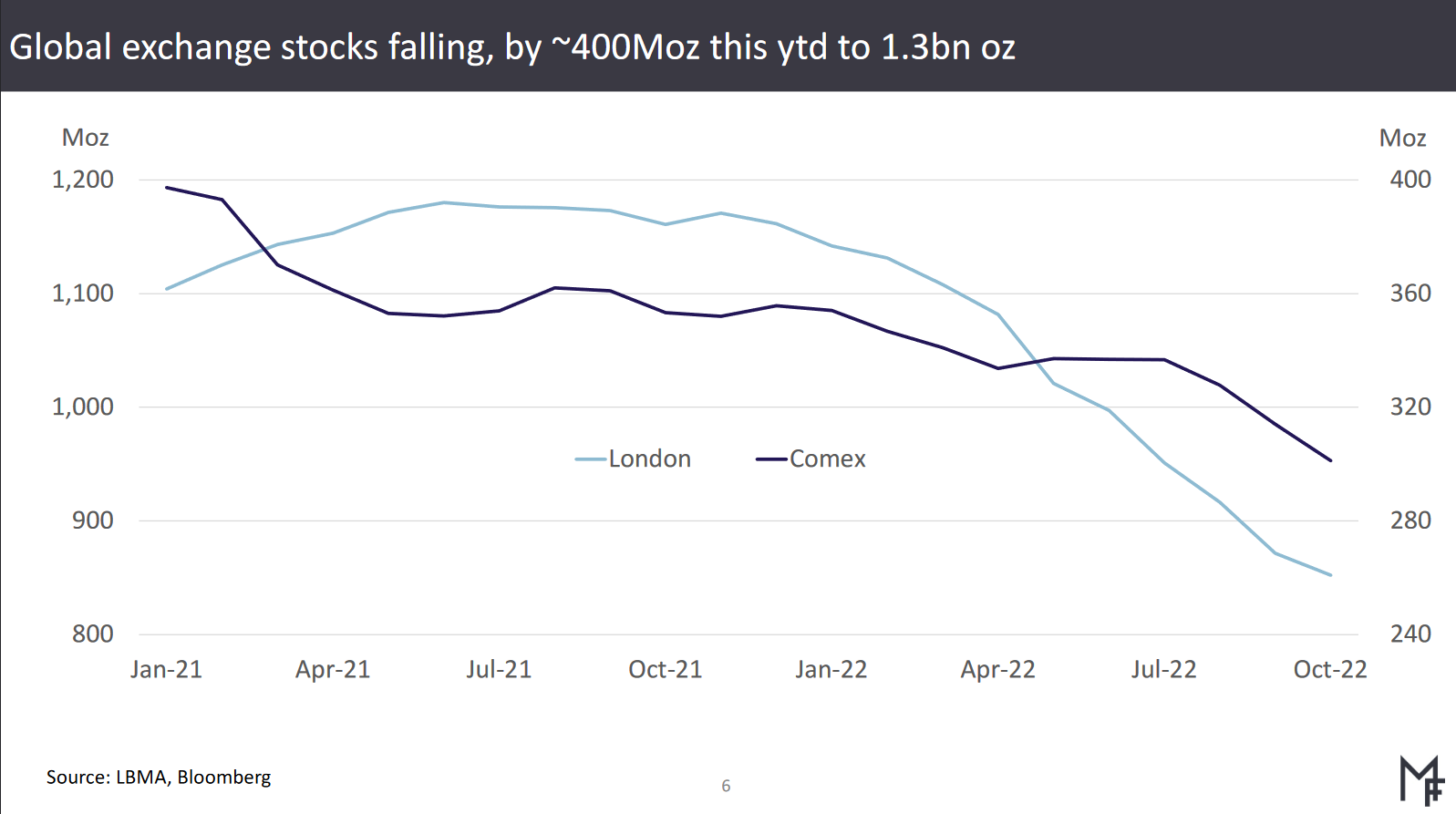

The deficit is confirmed by the Silver Institute’s data provided in the Interim Silver Market Review Report. The chart below illustrates how much silver stocks have been falling away from the two major western markets.

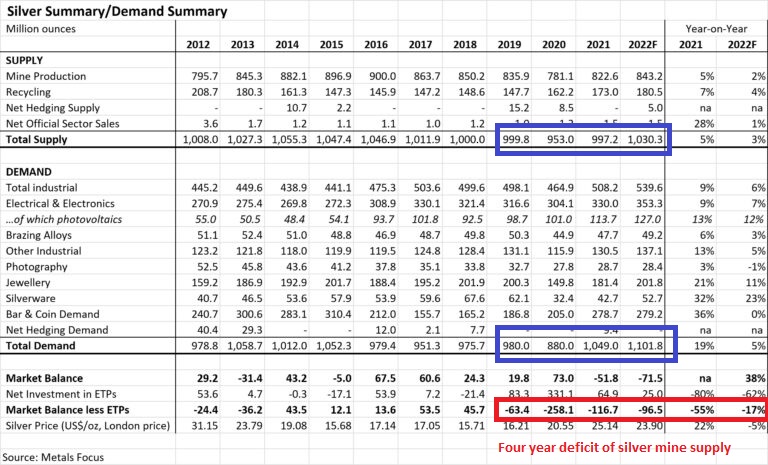

Overall, we still have enough silver-feeding western businesses that we are ok. However, the trend is decidedly negative on future silver supplies for several reasons. The mines are not putting out as much silver as we need on a yearly basis, and this trend is now four years old. See the chart from Silver Institute on world supply and demand.

The basic thesis is that while increasing demand, supplies would dwindle and prices would need to come up to encourage new silver mine exploration and development. The problem; however, is that precious metals markets don’t work in a straight line.

Often, commodities traders ignore data on the physical market until it reaches an inflection point, at which traders will all move in at the same time. It’s typical market herd mentality – nobody wants to be the first to reverse course on their trades until they have to. That time may be coming sooner than later and forms the basis for the rest of this article.

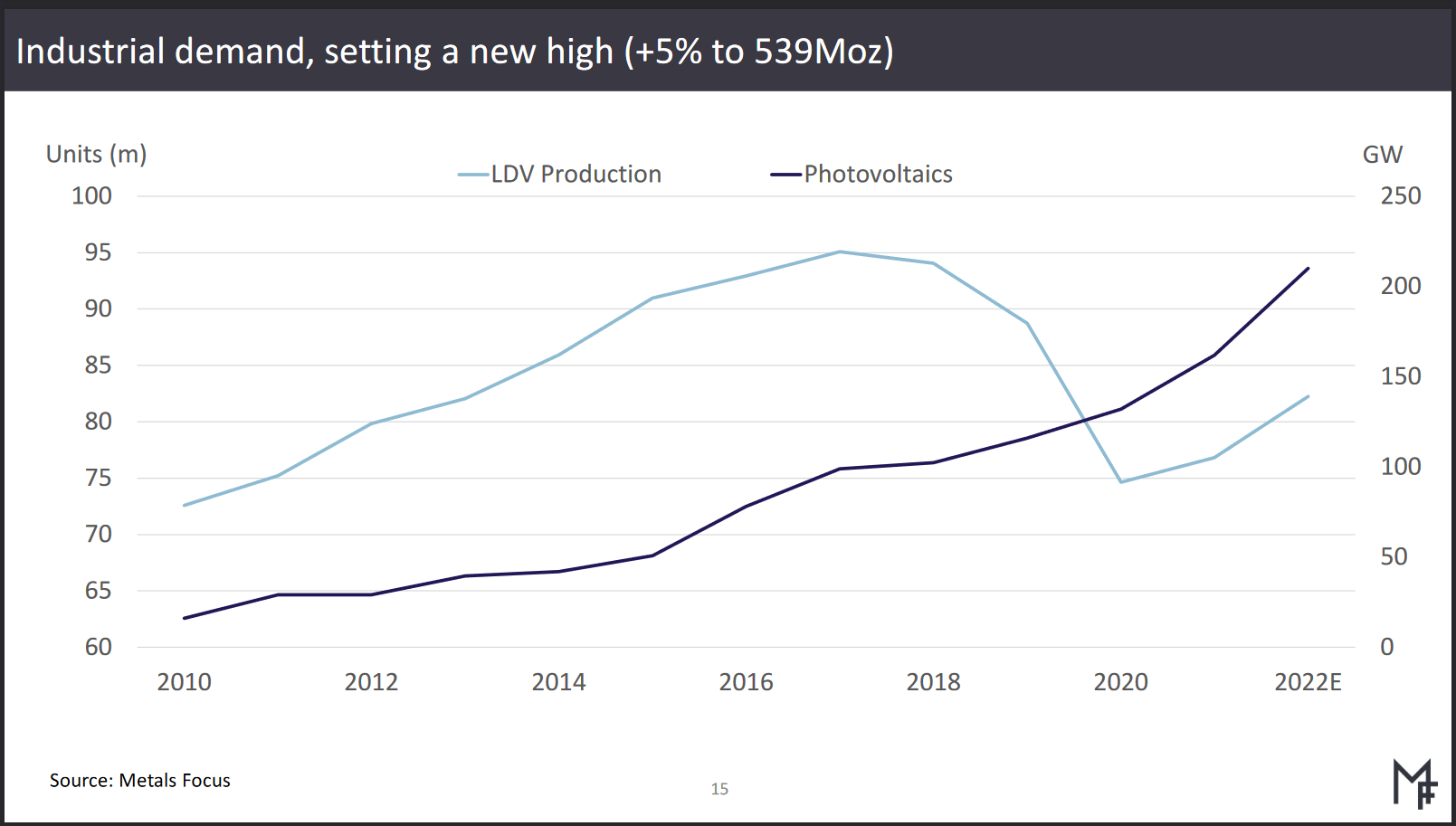

Industrial Demand Increases

What the Silver Institute’s Interim Market report also highlights are the increases in industrial demand. As we can see on this chart, silver industrial demand has caught up to pre-pandemic levels and has led to the trend of increasing demand dating back over a decade.

Jewelry demand is also up 25% to 235 million ounces and bar and coin investments are up 18% to 329 million ounces. Overall, silver market demand is strong and growing stronger by the day. Overall global demand is up 16% to 1.21 billion ounces per year.

The data seems bullish for silver, but the metal is still trading around $21 at the time of this writing. The market hasn’t recognized the annual supply deficit because it didn’t have to. The inventories on COMEX and in London seemed sufficient until the last two years when the demand increases forced the market to recognize what could be a real physical shortage in just a few short months.

China is Bleeding Silver Too

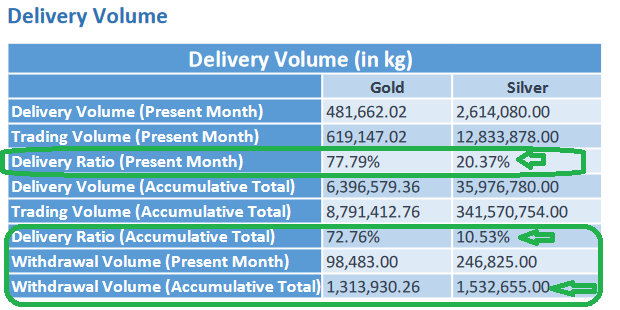

China’s Shanghai Exchange publishes information on the Chinese market trade for gold, silver, and platinum. I noticed the October report has some interesting information on trends. Overall, deliveries of physical metal on the Chinese market are much higher than on the western markets. So if there was increased demand for deliveries, one would expect that to show up in the data. And it has to end the year in a big way.

From the chart above we can see that silver deliveries for October were 20.37%, up from 10.53% averaged over the year. The market is demanding more silver be delivered on a contract than the average for 2022. Further, the withdrawals off of the exchange have also accelerated. October saw 246 thousand kilograms of gold removed from the Shanghai exchange, about double the average for a given month.

It appears the trend of physical demand increasing is true across the world, not just in the Western markets. This lines up with the Silver Institute reporting on increasing deficits year over year for silver supplies.

Prices are higher in China on precious metals than on the COMEX, to the tune of a $45 premium on a similar gold contract. While for gold, it shows that higher physical deliveries lead to higher prices on the exchange. I believe that the Chinese market is telling us, in effect, that a run on silver has begun not only in the western world but worldwide. I think it shows what the rest of us will see here in the West before very long – much higher physical demand than supplies and rising prices.

The Payoff

So when does the silver market boom happen? That is a good question. The fundamentals are screaming higher prices right now. But the paper markets take time to catch up to the physical ones. I know already that the bullion banks, or what I call the smart money in the commodities, are net long in silver on the COMEX.

I cover this in the weekly market wrapup that I do for the JM Bullion YouTube channel. You can catch those reports every Sunday night (or Monday morning) by tuning into the channel and listening to the data. I read out the major points in the gold and silver markets, and in addition, review the weekly economic data and major stories of the week driving markets. It’s a great report that you should consider tuning into every week.

The long-haul boom that many of us have been waiting for in silver is almost here. It may only be a few months yet. On the other hand, I suspect there are a couple of sneaky inventories of large piles of silver in a few places. Perhaps an investor or two has been ‘holding’ for a couple of decades. Perhaps a silver producer has been holding inventory back waiting on higher prices.

In either case, the overall trend is decidedly strong for physical silver. And this additional data from the Chinese market confirms it. Time will tell where we land up in silver, but I expect the story is going to be a very, very interesting one.