This week we are going back to the economy to examine where we are post-bank failures and a resulting positive bump in the precious metals prices. I know investors are happy that gold is back in vogue again. After all, trading within a few dollars of the all-time high is a nice place to be. And it is definitely nice to see Silver sitting atop $25 for a second week.

I believe these are confirmations that we are in the beginning stages of the eventual blowoff top in the precious metals. Yes, I think even the metals will go into a bubble during the next recession. But this will take some time to play out as we learn just how deep the problems in the economy really go, and what the political and monetary authorities may have up their sleeves to deal with it.

Gold is Rising Again

Gold is firmly back in the driver’s seat in the financial sector. The metal has approached its all-time high of ~$2070 in the past couple of weeks, and it took an impressive amount of shorting by bullion banks recently to bring the prices down. Why would the bullion banks short gold on the industrial exchange, you may ask?

Well, they do because they have paper bets in both the options and futures markets and stand to lose a lot of money if their price targets aren’t realized. In addition, they could simply lose money if gold moves too strongly past their overall speculative position. Remember, spot prices are mostly about speculation and not physical demand for the metal.

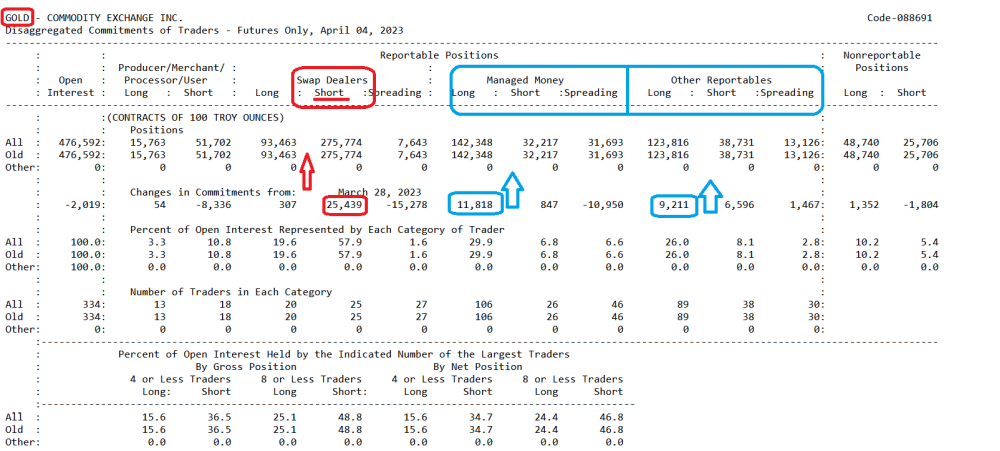

The picture below is from the Commitment of Traders (COT) report from April 4th that outlines trading by groupings, and the bullion banks wanted gold to stop rising by placing a whopping 25+ thousand short contracts in a week. This is not a minor move; rather, it is a very bold and intentional one.

It is perfectly healthy for this type of action to occur in the gold and silver markets. The spot prices are determined by derivatives and not physical trading. While people are gobbling up physical metals, plenty of gold supply has kept the price from blowing off. There simply is not enough physical demand to overcome the derivative futures trading, and subsequently spike gold now. However, recent events have certainly woken up the sleeping giant as investors begin taking positions ahead of what even mainstream media is not warning about – the dollar failure.

The next big news event is likely to spike gold up again. But what is different this time is there is global support for gold as the impending worldwide recession looms. And probably more importantly, the American media made a stunning admission this week that the US dollar is in serious trouble.

US Dollar Failure?

I have talked for years about the pressure that the US dollar would come under when we had our final reconciliation on the national debt. The original claim was in my book which I published in 2010. As it turns out, the debt does matter! The world is deleveraging out of ours, causing bond rates on US treasuries to spike. It is this change in bond prices that bankrupted Silicon Valley Bank and Signature. And it threatens the sovereign balance sheets of countries like China, India, etc. that hold a lot of US debt. We have written articles in recent weeks discussing this dynamic which is now coming to fruition.

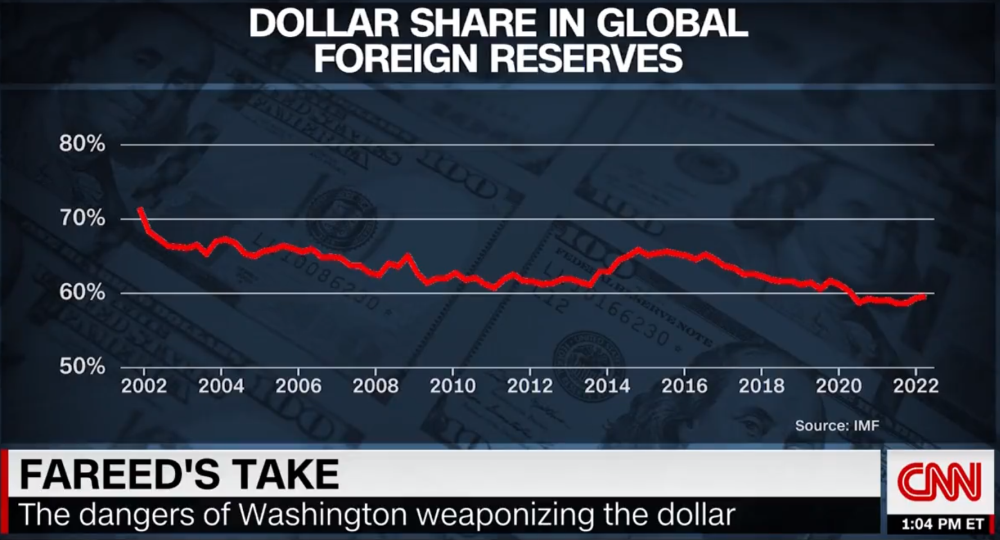

Dollar failure is no longer just the rantings of the alternative media. The mainstream financial media came out on Fox News and CNN this week and openly discussed the trade agreements for oil and goods outside the dollar, and how this could cause serious harm. They also mentioned the Belt and Road initiative and China’s trading network and how the US is not a part of it.

Repeatedly they described what a dollar collapse may look like and blamed the issue on dollar weaponization against other countries. Suddenly, the financial media wants to discuss the post-dollar era. Fortunately, these are things we have been discussing in our industry for well over a decade and have prepared our followers accordingly. Gold and silver investors, in general, are likely to be way ahead of the game.

Here is What Comes Next

Typically, when this type of news comes out in the mainstream, I consider it a type of public preparation or grooming for what is likely to come next. The powers that be in the financial and political worlds already have their solution, and it is the central bank digital currencies.

I wrote recently that adoption attempts in China and Nigeria for their sovereign CBDCs didn’t go off too well. The reality is, however, that when the dollar comes under tremendous pressure, the world is going to need a replacement. Financial media is already mentioning the ‘need for a replacement currency for the dollar’ that serves as the world’s reserve. However, this may not go over too well with the BRICS nations that have effectively put into place an alternative world economy that doesn’t rely on Western currencies or financial systems.

I think we are entering a period of multi-polar currencies, financial systems technology, and commodities markets. We have several blocks lining up, and it appears as though parts of Europe want to break away from the dollar system as well. There will be tremendous pressure to find a dollar replacement in global trade. But given political disagreements, I doubt we will land on a single currency even if it is blockchain-based like the central bank digital currencies are.

DCMA and the UMU

I consider this next offering with a bit of skepticism, but I wouldn’t sleep on it either. Recently an organization called the DCMA. This appears to be an organization run by a couple of people and has not received any sort of formal recognition in the central banking sectors. However, the group has spoken at events with the IMF and other international finance bodies. And those bodies are listening to what the DCMA is saying, at the very least. I think it is this relationship that gives us a clue as to what could come next.

The DCMA is advocating for a worldwide electronic currency called the Universal Monetary Unit (UMU). This would be based on blockchain but capable of transacting commerce across the world. The currency would run atop something called the Unicoin Network, which claims to offer an impressive list of features from tokenization, money services, and forex (currency exchange) as well as many others. Essentially, the founder took the list of wants from the IMF and central banks and built a template for what a universal currency could look like.

While this appears to still be in the idea phase, the acknowledgment that world leaders are contemplating a single world currency tells us what the roadmap may eventually be for digital currencies. The central bank digital currency era appears to be kicking off with quite a bit of support and interest from policymakers around the world and hence should capture some of our attention as we watch the new system unfold. We will continue to watch and report on it here.

Coin of the Week

As for gold and silver, I continue to see them as a hedge against everything we may be talking about here during a currency reset. I believe gold will once again serve as a sort of bedrock for the new financial system.

It’s just that most of it will be owned by banks and wealthy individuals, with a small percentage of us regular folk participating in the market as well. There will be a time, however, when precious metals are too expensive for most of us. Therefore, the time to get them is now.

The coins I want to highlight are in the Medieval Legends series. They come in both copper and silver options and highlight an era in which precious metals were the coins of the realm. Plus, they are gorgeous pieces to boot and a great coin to add to your collection.