The economic news this week has seemed a bit funny to me. We have had these speeches by the various members of the Federal Reserve (the US central bank) discussing the need for potential further rate hikes to slow down inflation. Case in point, Chairman Jerome Powell said the following this week:

“Price stability is the bedrock of a healthy economy and provides the public with immeasurable benefits over time. But restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy.”

Elsewhere, San Francisco Fed President Mary Daly expects rates may have to go as high as 5% to get inflation down. Atlanta Fed President Raphael Bostic thinks not only should the rates be 5%, but they should be held there for a long time.

It’s not what the Fed members are saying about interest rates that puzzle me, but the reaction of the stock markets to what the Fed said. I will explain what I mean next.

Rising Rates are Deflationary Across the Board

When a central bank raises interest rates, they are saying that they expect persistent levels of inflation and therefore are making a coordinated policy decision to change their lending rate to banks. When the rates are low, banks can get cheap money at the Fed’s window. Meaning, if the Fed has low-interest rates, then the money is much easier to borrow and pay back.

When the Fed starts raising interest rates to counter inflation during a late business cycle, we should expect borrowing to decline. Banks will pass the higher rates to anyone applying for a loan including businesses.

After all, the cheaper money the economy was used to is now more expensive. Much like we may opt for a smaller house, and therefore a smaller loan size when interest rates are higher, we should expect the same decision to spread across the economy.

After all, businesses have bills too. And they have budgets. When the cost to run their business rises, businesses adjust their spending and their expectations for their output. When stretched across an entire economy, most businesses tend to make the same decision. And the effect of the lesser output from businesses leads to inflation.

Well, that and the consumer who was also affected by higher rates, and therefore higher prices for most things they are going to purchase. Given the same budget, consumers simply have to buy fewer overall goods. This is deflationary to the economy, by design. It is the slowing down of an economy that has lived on inexpensive borrowing for so long.

This is what the Fed is intentionally doing, and I applaud them for their efforts. Eventually, the business cycle catches up and forces the economy to slow down. Whether or not the conservative Fed policies will work this time is a question for another article.

The Stock Market Going Up?

The stock market has been rising all week upon digesting the news from the central bank that everything is about to get more expensive. From the debt they take on, to the cost of purchasing materials, the cost of labor, and the cost of just about everything that goes into their budget.

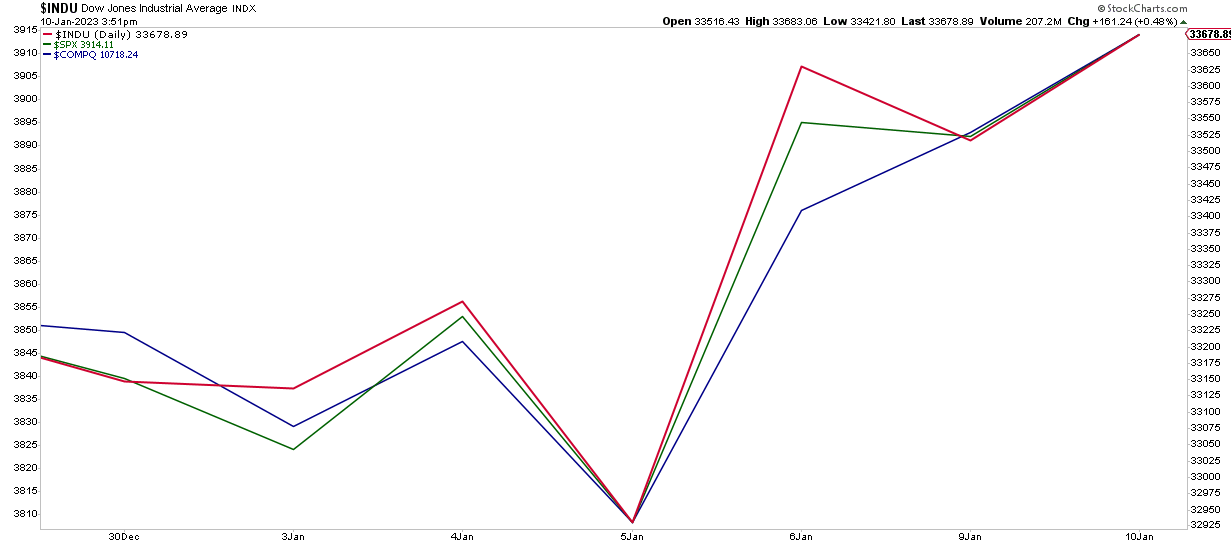

Being that the stock market is made up of these businesses, the action for the last few days was confusing. The major US markets, defined here as the Dow Jones, S&P500, Russel 2000, and NASDAQ are all up on the week and dating back as well to late last week. See below for the price action this week.

Say what?

The markets appear to be euphoric over the Fed news partly because the Fed seems to be holding to their current targets, which is a bit of a change. Last year the Fed started at a 1.8% target and eventually moved to 5.25% interest rates. It is as if now that the Fed more clearly issued forward guidance on what they are going to do, interest rates and deflation are all of a sudden, not an issue.

What will likely happen in the longer term is that business cutbacks will reduce overall spending and force company stock valuations to correct. In other words, we are certainly NOT out of the woods yet on this economy. I will warn readers that we have more road to travel before the structural challenges in the economy will subside.

And it’s not just deflation that needs to occur, but a longer working out of the challenges that have not been corrected to date. At the moment, the Fed is addressing the symptoms of the economy to stabilize it, but they cannot address the fundamentals. That is up to policymakers in Congress along with both consumers and businesses making more conservative financial decisions.

Bad investments (bad debt) need to be cleaned out so that both consumer and business balance sheets improve. We are nowhere near where we need to be on both counts before the economy will have room to recover. We cannot have expansion until the junk is all cleaned out. We didn’t clean out all the junk in either the 2000 or 2008 recessions, so this time it’s going to take quite a bit more effort on all of our parts to get economically healthy in the US.

What Should Your Course of Action Be?

Given the deflation/inflation cycles, we are likely to be in the next couple of years as we work out this bad debt problem, consumers are going to have to make some hard financial decisions. Of course, I am biased, and at the same time not your financial advisor (disclaimer). But I think it is even more prudent to consider precious metals in your portfolio.

Gold and silver have a stabilizing influence when the rest of the economy is in a correction mode. Given how well gold and silver did in 2022 compared to the rest of the markets, I think it is pretty clear what to expect with the metals going forward over the long term. They should continue to rise.

I do; however, have one word of caution. The inflation/deflation cycles cause sell-offs in the market to remove bad debt and investment and to account for the higher cost of money in the market. Gold and silver will also sell off at times. This is normal and has been seen in many prior recessions. It is the long-term rises in prices that I pay attention to. After all, I am in this for the long haul.

The great news is that precious metals are best in a recessionary environment. They are also often used by the central banks as one of only 2-3 types of high-quality assets on the books, and I expect central banks to continue their gold buying spree of the last 11 years as a result.

I say, don’t fight them – better to join them. They know what’s coming in the markets, and their participation in the physical gold market is a clear sign of what smart investors should also consider doing with precious metals in their own budgets.

Rob Kientz is a precious metals industry expert with over twenty years of investment experience in bond, stock, real estate, commodities, Forex, and precious metals markets.