When doing research, I often come across different stories written from periods of past recessions that I find very interesting. Often times they offer not only a deeper glimpse into the times, but often are contrarian to popular opinion on the subject. And lo and behold, I found an article on the Fed website regarding the 1970s and 80s inflation that surprised me enough that it convinced me to write an article about it.

The Great Inflation

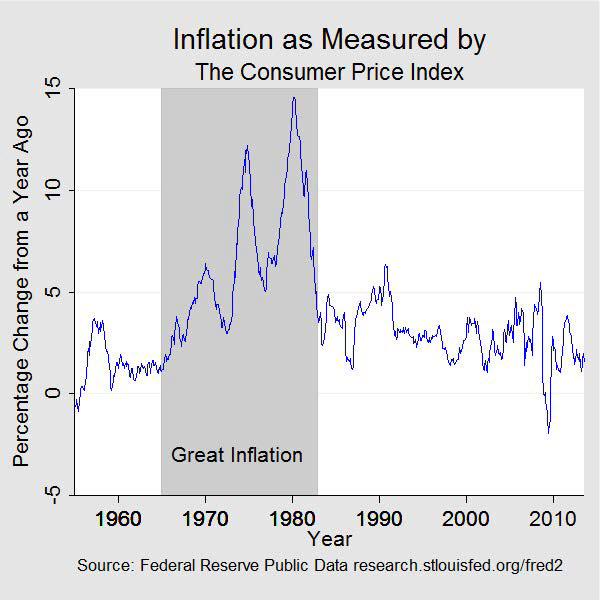

The Fed has dubbed the period from 1965 to about 1983 as the Great Inflation. See the chart below-depicting price inflation during the time period.

Why is this period so interesting to monetary researchers like myself? Well, take a look at this quote from Michael Bryan, Federal Reserve Bank of Atlanta, regarding the period.

“The Great Inflation was the defining macroeconomic event of the second half of the twentieth century. Over the nearly two decades it lasted, the global monetary system established during World War II was abandoned, there were four economic recessions, two severe energy shortages, and the unprecedented peacetime implementation of wage and price controls. It was, according to one prominent economist, “the greatest failure of American macroeconomic policy in the postwar period” (Siegel 1994).”

So, it appears to be an important event by all accounts. I do remember, having been born in 1974, that my mother would complain over and over about prices. Every time we went to the grocery store, it cost more to fill up a cart and we were able to bring home much less. I lived in a single-parent household after my father died when I was a baby. And inflation really affected the ability of families like mine to buy the basics like food and gas.

This tale culminates one year when as a 16-year-old young man, my family could not afford Thanksgiving dinner. We simply didn’t have the money to buy the Turkey and everything that went along with it. But I did have one thing – friends. You see I worked at a Winn Dixie grocery store as a cashier, and my manager knew about my situation. On the day before Thanksgiving at the end of my shift, there was a note for me to go back to the store Deli.

I was handed a shopping cart with a Turkey and all the other traditional Thanksgiving side dishes that I could ask for, courtesy of a ‘friend’. I knew just who it was, and I never forgot that simple act of kindness. It had saved Thanksgiving that year for me and my family. But it meant more that it came from someone that had really cared. It is that memory that I recount every year at Thanksgiving simply because it reminds me to be humble and appreciative of everything that I have. And that I will never forget that act of kindness.

The Fed’s Policy Mistakes

Getting back to the Fed article, I found it surprising in its candor. The author does not hold back on the failed Fed policies that led to the high inflation period. And the detail about how it all happened is right there for anyone to read.

To summarize, the Great Inflation occurred in 3 stages. In the Employment Act of 1946, Congress established the dual mandate of the Fed to maintain the growth of monetary aggregates to stimulate employment, stable prices, and keep long-term interest rates low. All of those goals seemed important at the time, given the world war that we had gone through. But it also set the stage for the later era of quantitative easing (QE) that would mark the easiest money era of our nation’s history starting in 2009.

Economic thinks of the day relied heavily on the Phillips Curve which represented a long-term tradeoff between unemployment, thought of to be the worst of economic problems and inflation which had been thought of to that point as a minor ‘inconvenience’ at the time. Two economists cautioned about relying on the Philips curve to set aggregate monetary policy; however, noting what will become to historians of the future a very prophetic warning. Per the Fed article:

“But the stability of the Phillips curve was a fateful assumption, one that economists Edmund Phelps (1967) and Milton Friedman (1968) warned against. Said Phelps “[I]f the statical ‘optimum’ is chosen, it is reasonable to suppose that the participants in product and labor markets will learn to expect inflation…and that, because of their rational, anticipatory behavior, the Phillips Curve will gradually shift upward…” (Phelps 1967; Friedman 1968). In other words, the trade-off between lower unemployment and more inflation that policymakers may have wanted to pursue would likely be a false bargain, requiring ever higher inflation to maintain.”

Isn’t that phenomenon exactly what we are experiencing now? High inflation with persistent low overall employment rates, as measured by the Labor Force Participation rate. Many countries chased the Phillips curve and abandoned their role in Bretton Woods, causing differences in monetary policy that eventually rendered that agreement ineffective.

The Government’s Role in Inflation

Back at home, congress began utilizing this newfound love of the Phillips curve to steadily expand spending after the end of the gold redeemability in 1971. The resulting fiscal policies by the nation led to larger and larger deficits that had to be funded with easy credit policies and an expanding money supply. All of these were done with bad assumptions made on bad data. To wit:

“Bad data (or at least a bad understanding of the data) also handicapped policymakers. Looking back at the information policymakers had in hand during the period leading up to and during the Great Inflation, economist Athanasios Orphanides has shown that the real-time estimate of potential output was significantly overstated, and the estimate of the rate of unemployment consistent with full employment was significantly understated. In other words, policymakers were also likely to underestimate the inflationary effects of their policies. In fact, the policy path they were on simply wasn’t feasible without accelerating inflation (Orphanides 1997; Orphanides 2002).”

The period of rising inflation lasted for years, largely as a result of growth policies by Congress in the quest to meet all of their constituent needs. The problem is that we as a nation expected too much expanded too fast, and forgot to pay attention to the warning lights on the dashboard about the effects. All the while, the Fed simply did what it always did in accommodating expanding government fiscal needs with ever more accommodating monetary policy.

In the end, the current period of inflation can be blamed on the whole of the legislation and policies affected by Congress, and supported by the Fed, on behalf of the American People. And whether or not we individually supported these policies and actions, the fact is we all have to deal with them.

I believe the story on high inflation is not over yet. I believe we are entering into another long period of inflation that will once again affect families like mine and yours. And once again, we are going to have to count on each other as a community to get through it, just like we all did the last time this occurred.

A Thanksgiving Lesson

So here we are just about ready for Thanksgiving in 2022. An American holiday, I do believe the principles of the holiday should be shared far and wide. Just this morning, I was out getting a coffee and breakfast at a local convenience store when I talked with the store’s cashier for perhaps the 100th time.

And it was this time she shared her story – with the higher prices this year, she could not afford to put a traditional Thanksgiving Day meal on the table for her family. You see she is a single mom with two kids at home, just like my mother was with us growing up. And this year, inflation had finally robbed her of her ability to participate in one of the grandest American traditions of them all.

This is a woman who, when North Texas experienced debilitating winter storms two years in a row, worked overtime for several days without sleep at her store during both episodes. This store was across the street from me and easy for me to get to. It is also the only convenience store on my side of town servicing a large hotel district and apartments for city residents. We have no grocery stores nearby, much to the chagrin of our neighbors. That was our community’s only source of food, water, and warmth when we had no power to heat our homes. And she could have stayed home.

Speaking with her, it reminded me of Thanksgiving when I was 16 and how a friend had given a special gift that allowed us to have a normal holiday with family. This year it was my turn. I returned to the convenience store 30 minutes later this morning with a gift card with enough money for both Thanksgiving and Christmas dinners. And I thanked her for being there when we needed it the most. This time, I told her, the community would take care of her as she had for us.

Because that’s what we all do in times of need. And it is that spirit that I love this time of year so much.

Coin of the Week

Given persistent high inflation, it is no surprise that I turn to gold and silver to save my wealth. For this week’s coin of the week, I settled on a simple Thanksgiving bar from SilverTowne. I have purchased many bars from SilverTowne over the years, and this design is simple and commemorative of the day. What else could you ask for? Nothing, in my eyes. I already have everything that I need.