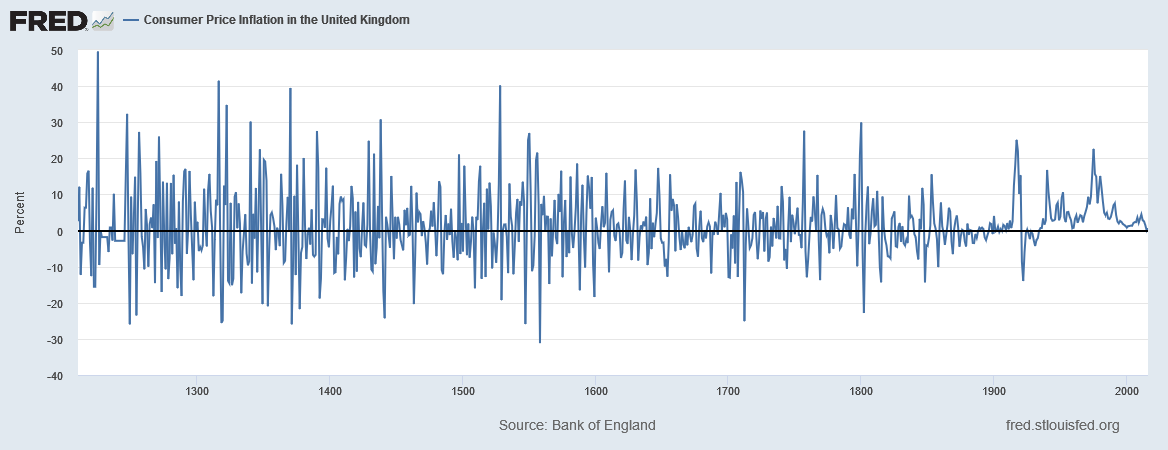

The debate between inflation and deflation has a long and storied history. Typically, bouts of high inflation are met with periods of deflation, or reduction in growth. For example, take a look at this long-term chart of the UK from the Federal Reserve.

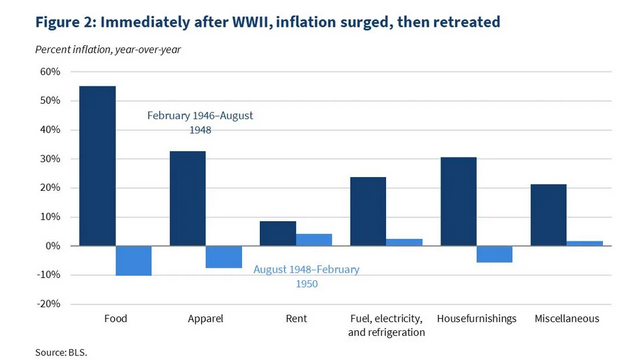

It is very easy to notice that inflation does not last forever. After periods of high inflation, economies tend to regress and growth recedes. This is normal as inflation reduces the purchasing power of consumers and forces demand destruction to occur. Producers stop producing as many products to account for ballooning inventories. Which is pretty much where the US sits now.

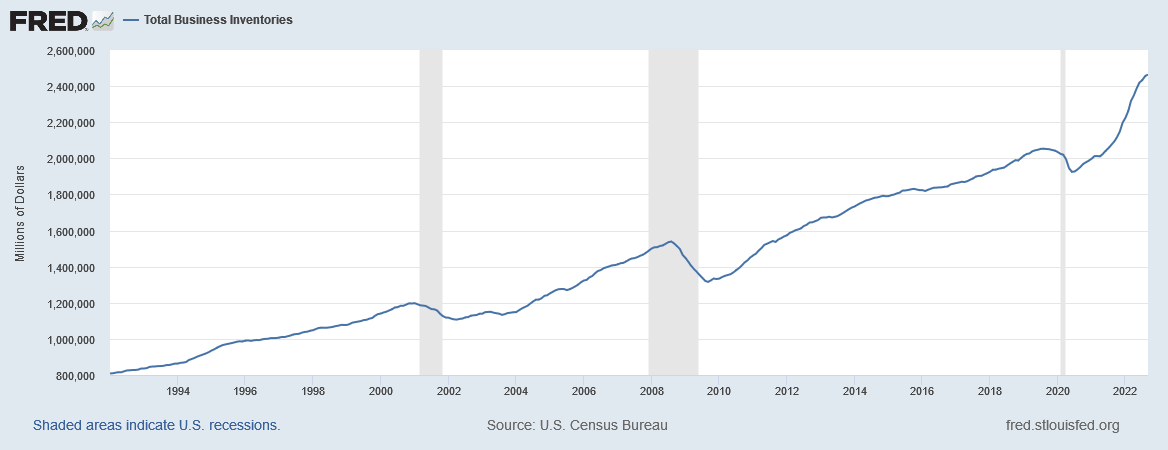

As you can see in the graph above from the Fed, US business inventories have been on a steady rise since the Great Recession. While we see an increase in inventories since the early 90s, it is particularly interesting to see the resumption of inventory levels after the pandemic. While everyone, including this author, was writing about supply chain problems, businesses in the US continued to increase production and therefore inventories of goods.

Inventory Glut and Coming Deflation

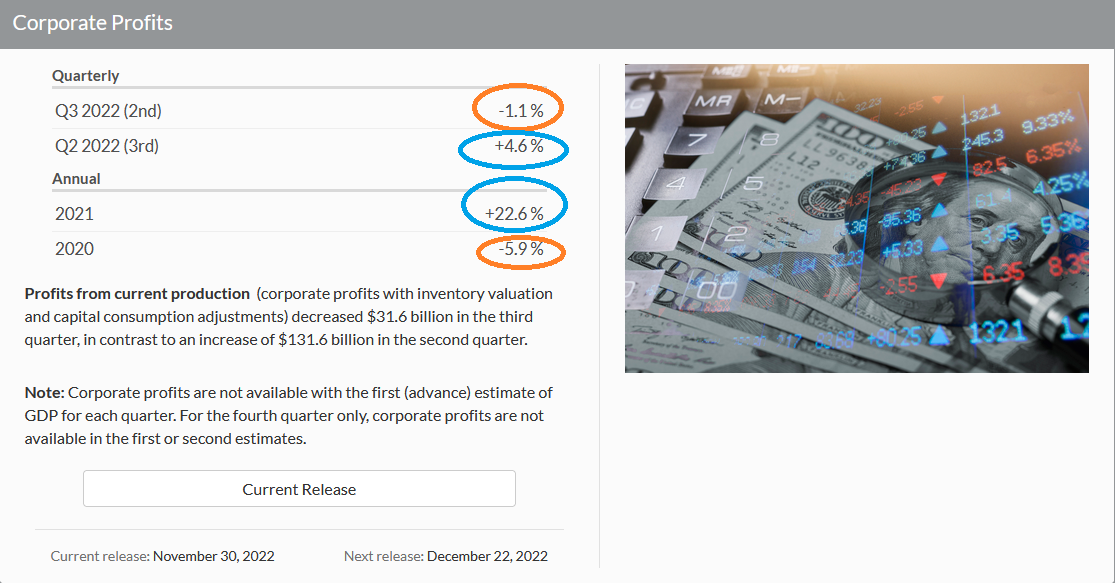

Are continuously rising inventories good for the economy? Not when the consumer cannot afford them. Think about input costs for a moment. We know commodity prices have been rising for some time, putting pressure on the profits of US enterprises. Corporate profits have been falling since 2018, with a modest period of increase after the economic restart in 2020-2021.

However, the data from last year is an anomaly because it depicts only the rise in corporate sales for 2021 during a time at which companies could print money from selling inventory to consumers with 18 months of pent-up demand due to the shutdowns. However, it is clear that the US seems to be following the pattern established in the UK economy where high periods of inflation spur high production, the onset of inventory gluts, and the fire-sale of assets against falling demand from consumers that are tapped out financially.

The chart above shows what happens to consumer credit during recessions. Purchases fall when the economy hits tough times. People learn to do without. But before that period, as inflation reaches its peak, consumers are increasing spending on credit to account for higher prices and a fixed budget. Recent credit debt figures show that the US consumer is currently tapped out, and only a deflationary collapse in the economy will lower prices enough to reduce their purchases on credit.

Deflation is Natural

Deflation in prices occurs for the following reasons:

>Technology and innovation

>Fiscal dynamics

>Labour market slack

>Ongoing globalisation

Lets examine those for a minute. Technology innovation constantly occurs and provides increasing efficiency over time. This would tend to decrease good costs and increase happiness of consumers. However, technology itself cannot seem to overcome other inflationary forces in the economy.

Labor market slack is definitely an issue in the US, as the labor force participation rate has not recovered since the 2000 tech crisis. The labor market is not strengthening to offset other deflationary forces in the economy.

Globalization has definitely affected the prices of goods. It allowed companies to lower costs by exporting labor and product to cheaper countries, thereby providing the impetus needed for a rapidly expanding global GDP. The problem is that now deglobalization trends are accelerating due to geopolitical conflict and the subsequent rise in energy and basic commodity prices. Will deglobalization raise price expectations? At the moment, economists are not of that opinion.

Fiscal dynamics are also a big part of the inflation/deflation dynamic. At the moment, the US, much like the rest of the world, is suffering from high levels of debt. This debt puts an overhang on the entire economy as servicing costs increase, reducing free cash flow to increase CAPEX expenditures on things like R&D, labor, and purchases of new technology. Therefore, one would expect fiscal dynamics to temporarily offset the impacts that technology has on prices.

Overall, we expect deflationary forces to win in the short term, which is the norm for the US economy. See chart above where it is clear that large bouts of inflation tend to lead to periods of economic deflation.

Demand Destruction

So where do we stand with regards to the US economy? I have said in previous writings that the world economy has been overheated and signs of a recession are coming. It appears as though the pattern of alternating high inflation, couple with economic deflation and recession, are repeating again. The result will be falling prices on lots of goods and services, which will cut into corporate profits.

With the fall in corporate profits, I expect employment levels to continue to fall. It is clear that the economic trade-off between inflation and unemployment was a transitory occurrence. Research indicates that unemployment is increasing despite inflation levels being high. The traditional thought of economists, when using the Phillips Curve, is that we could trade higher inflation for lower unemployment.

That dynamic appears to be broken, according to this 2013 study done by several prominent economists.

What Comes Next

I expect that recessionary forces will put the economy into a bit of a tailspin, and lower overall consumer prices. While this is true, I also expect supply chain challenges to keep energy, food, and other prices high. I expect demand for high-ticket items such as housing and cars to fall as consumers hold on to what they have, and delay new purchases for a future point in time.

The next question is what happens to the US economy during deflation? And given the over decade-long money printing spree by the majority of the world’s central banks, will deflation mean a collapse in confidence in national currencies? Certainly having too much currency in a period of falling demand cannot be bullish for say, the US dollar.

Coin of the Week

I am a pretty big soccer fan, dating back to my formative years playing rec and high school ball. This year’s World Cup has provided some thrilling moments, from the emergence of Argentina’s Messi as one of the best players in history and his willing of his team through the tournament, to the Cinderella story of Morocco. With that in mind, I bring you the silver soccer ball! What a great piece to add to the sporting man’s collection. I will be adding one of these to my collection and encourage sporting fans everywhere to do the same in commemoration of a historic World Cup.