Back in 2008, all the talk in the financial media was on Lehman, the mortgage market, and how banks were going to survive the ‘financialpocalypse’. Somehow we managed to get past the mortgage crisis and the ensuing Great Recession, but the jury is still out on whether we truly learned our lessons from that time.

How Bonds Function

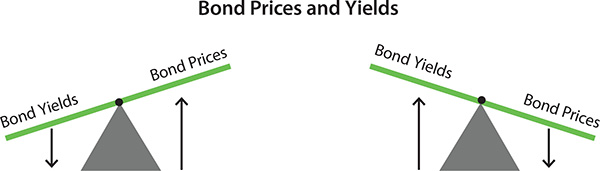

US Bond markets have come under some stress due to rising interest rates, as determined by the Fed. While bond interest rates are rising, the bond yields (defined as gain/loss on market price plus interest rates) have come under pressure. Sure, bondholders like it when interest rates rise because they get more yield on their investments. However, higher interest rates force lower prices on all bonds that came before it, because in bonds interest rates and prices move in opposite directions.

Bonds are an important part of the economy. They are used as hedges against market risk because they have long been considered the safest of the modern asset classes such as stocks, real estate, crypto, currencies, etc. This does not consider the really long history of gold, but financial advisors don’t make money from selling physical gold. Therefore, they typically don’t offer it or talk about it in financial presentations. So, the bond is the financial planner’s version of gold, in as much as both are considered to have some level of ‘safety’.

Bond Markets Fracturing

When the bond market is not functioning properly as a safe haven and low-risk asset, the market begins to panic. And that is what we are seeing, albeit in an early form. The banks and financial houses are starting to warn of some deep cracks in the foundation of the bond market. And that means an opportunity for those that invest in precious metals.

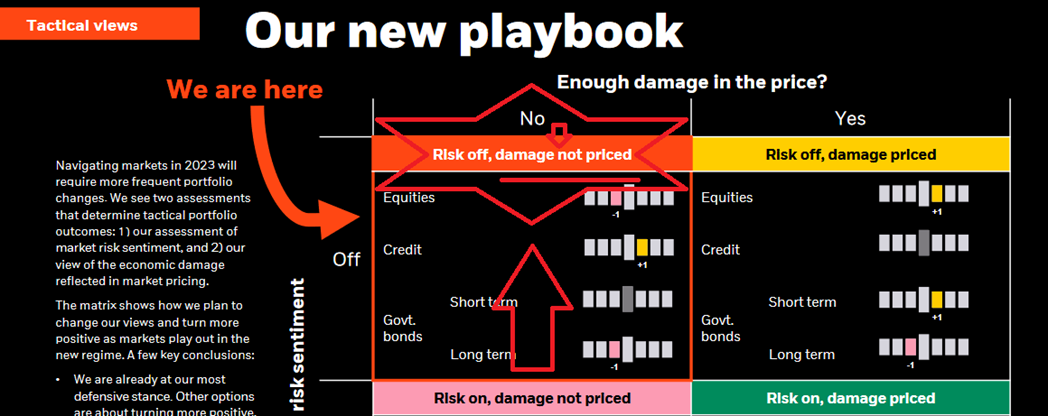

Per the Blackrock Investment Institute:

“The Great Moderation, the four-decade period of largely stable activity and inflation, is behind us. The new regime of greater macro and market volatility is playing out.”

Blackrock believes, looking at the chart of risk above, that the market has not priced in the pressures in the bond market. In other words, the markets haven’t assessed the risk of a potential bond market failure, or even a highly stressful event in a particular segment of the debt markets like we saw with mortgages in 2008-2009.

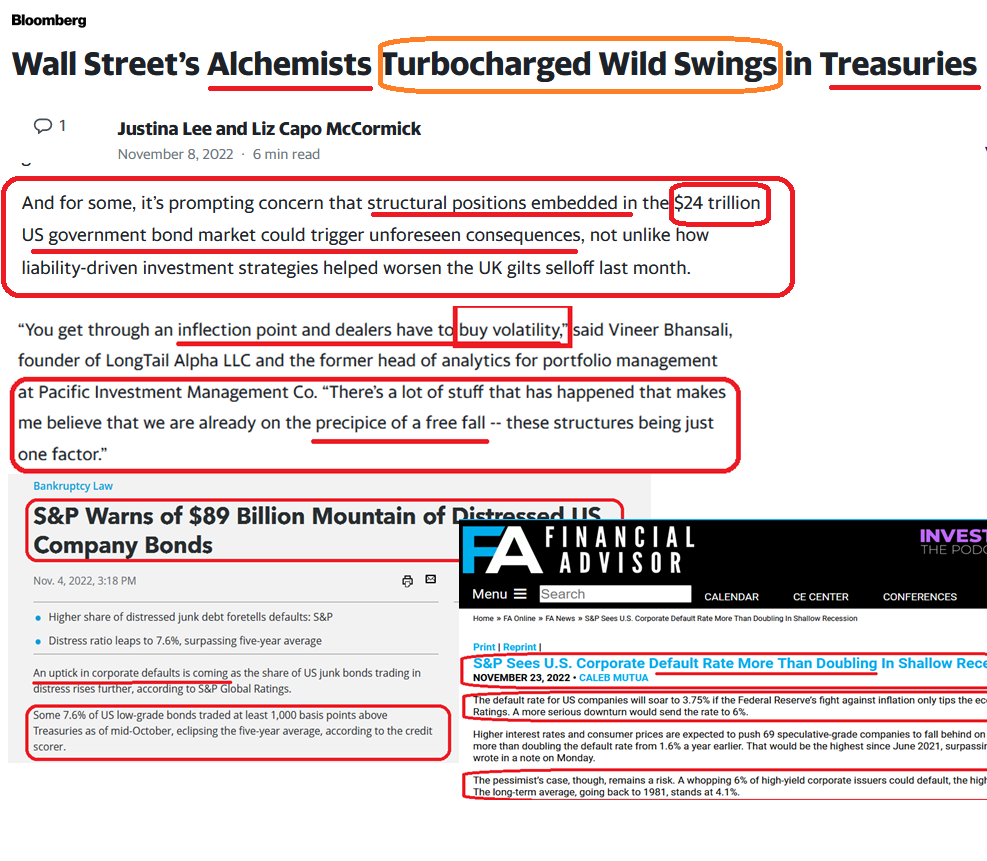

Researchers, however, are starting to sound the alarm. Bloomberg has been running a series of stories aimed at documenting the current stresses in the bond market. Here are some examples of headlines coming from their analysts.

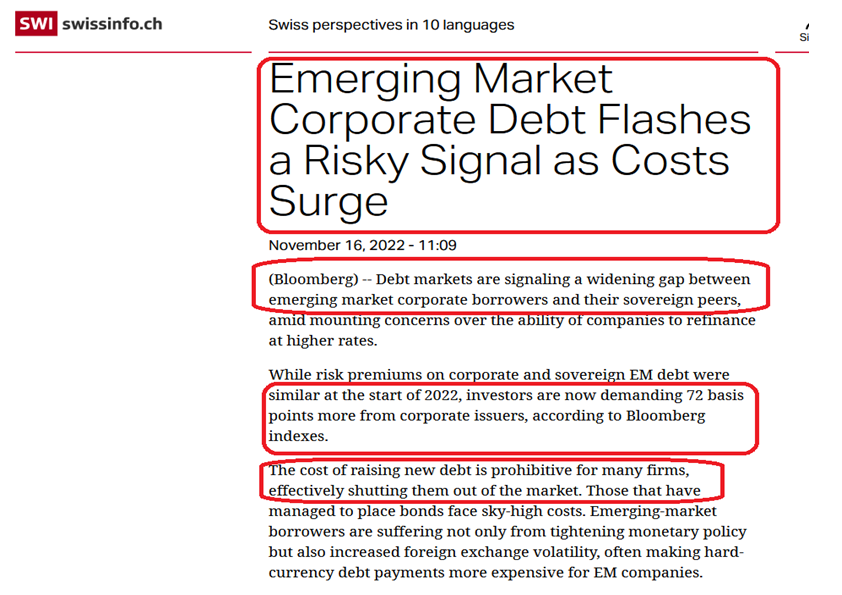

The problems are not limited to the major world economies. Emerging markets are seeing a large increase in risk. Companies in emerging markets are facing higher debt costs as a result of perceived risk against more established markets. This will simply make it harder for them to compete on a level playing field. Given that many emerging markets supply raw materials to the developed world, I believe that any extended problems in their debt markets will exacerbate supply chain problems already in play.

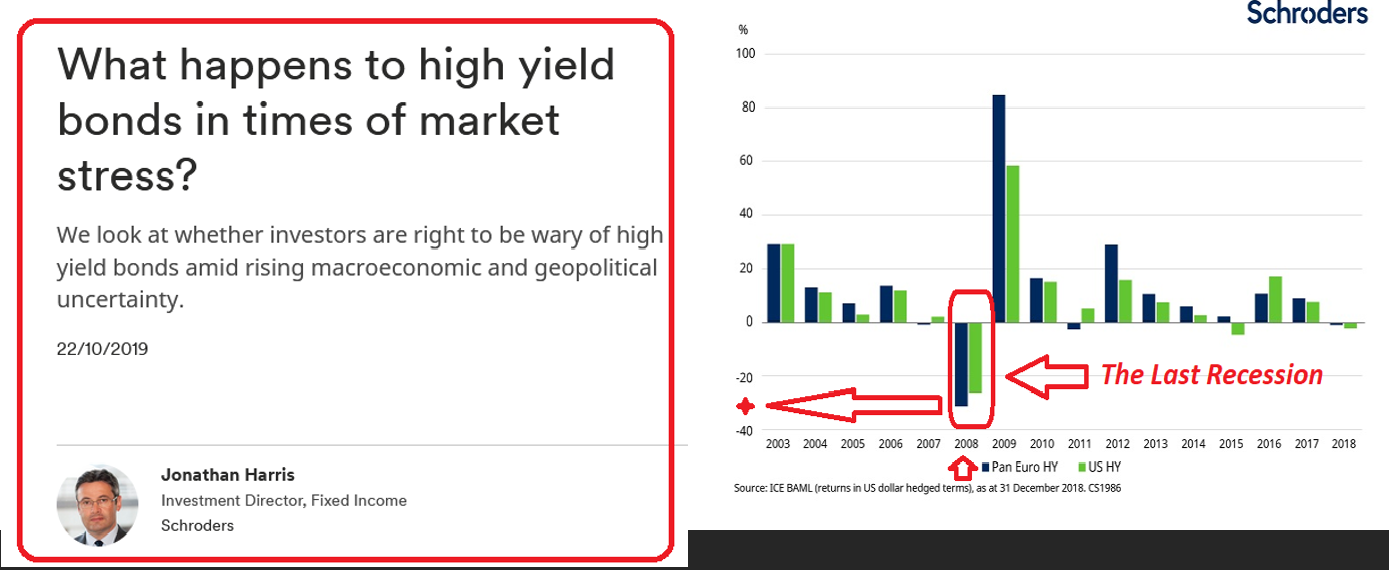

Lastly, the junk bond market is starting to crack as well. Highly speculative, junk debt refers to the class of companies that are highest risk per the rating agencies at paying back their debt. It does make sense for investors to ask for higher returns on this riskier debt, but there is also a point at which rates are not attractive even for the higher risk-taking investors. Why risk their money when there are likely much safer alternatives to wait out the storm? The chart below shows what happens to high-risk debt during economic stress, and it is not good for investors.

What’s the Downside Risk?

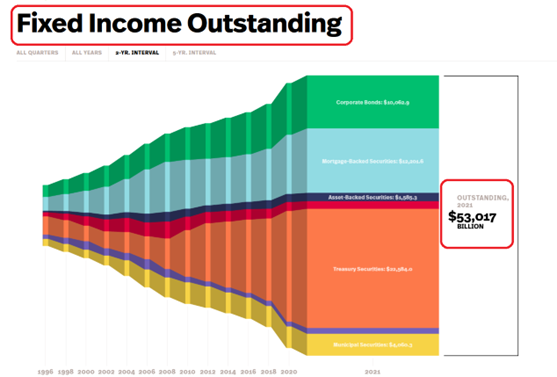

At this point, you may be asking what the risk is for the bond market. How bad can it really get, and is the potential for contagion to overwhelm the banks before they can respond? Well, the first thing we can do is look at the shape and size of the bond, or fixed income, market. See below from SIFMA (Securities Industry and Financial Markets Association), whose role is to speak on behalf of the industry.

That is over $53 trillion in fixed-income investments in the US. Compare that to the US GDP, the measure of annual output, which stands at $25.7 trillion. With the fixed income market at twice the annual national economic output, I think it is safe to say that the downside risk potential is ENORMOUS. Thus far, bond market volatility is already rising, as measured by the BofA ICE index.

Final Thoughts

Bonds have traditionally been seen as a safe haven asset for US investors. This time appears to be different, however, as the bond market has become the canary in the coal mine for the deep problems that have developed in the financial markets. These problems mirror the western world’s economic troubles that have been brewing since 2008. Those problems are not over yet, it appears they have just begun. This time, however, I believe the precious metals re-establish themselves as the last resort in a system desperately seeking safety.